|

| 4 September 2025 Calm before Q4 surge |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off on Wednesday. Total notional volume for the day came in at $508 million, 11% below 30-day average volume. Bitcoin volume printed $229 million, 4% below 30-day average volume. Ether volume came in at $195 million, 11% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,725 and average position size for ether at $3,351. Bitcoin volatility continues to consolidate off yearly low levels. Meanwhile, ETH volatility is cooling off after recently surging to the highest levels since December 2021. We’re looking at average daily ranges in bitcoin and ether of $2,831 and $223 respectively. |

| Latest industry news |

|

Bitcoin has extended its recent recovery, finding support amid rising stablecoin liquidity and renewed inflows. Ethereum has followed suit on the back of similar drivers. The bounce reflects a broader recovery across majors, with ETH’s recent record-breaking move above its 2021 highs still driving optimism for continuation into year-end. September has historically been a month of consolidation for crypto, before the stronger seasonal stretch in October and November. This year, however, consolidation may be shallower, as themes like ETF adoption, institutional allocations, and regulatory support provide a stronger fundamental backdrop heading into Q4. Institutional participation continues to deepen, with Bitcoin ETFs now rivaling gold funds in scale and ETH funds attracting steady inflows. Ethereum’s breakout to new all-time highs sets the stage for both assets to potentially extend records into the fourth quarter, supported by a steady flow of capital from investors positioning for long-term growth. For the first time, the balance-sheet integration of Bitcoin and Ethereum by corporates and asset managers is becoming a mainstream theme. Macro conditions are also leaning supportive. Market participants and the U.S. administration are increasingly pressuring the Fed toward rate cuts, which would favor risk assets, weaken the dollar, and reinforce the appeal of deflationary or scarce assets like gold and Bitcoin. Gold’s recent record highs underscore this dynamic, and the parallel narrative of limited-supply digital assets like BTC and ETH could drive incremental flows as investors seek alternatives to fiat. |

| LMAX Digital metrics | ||||

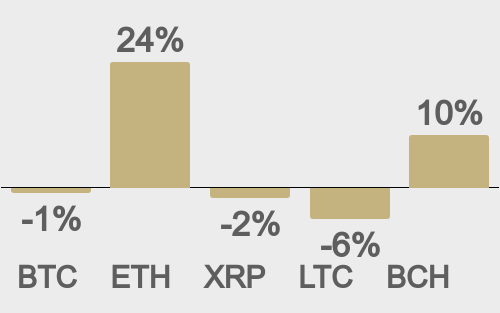

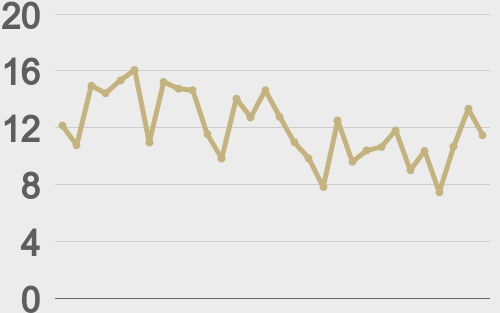

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

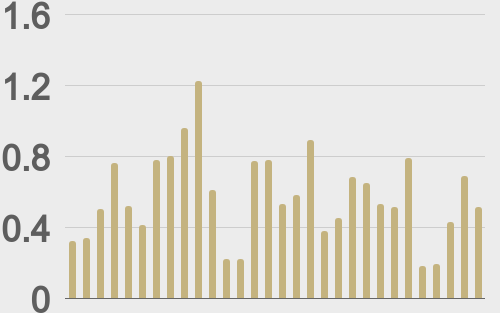

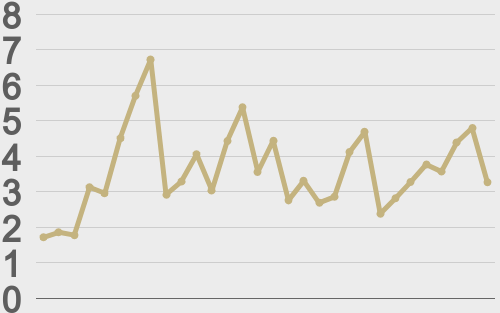

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

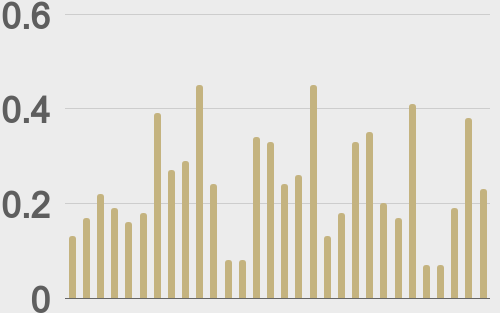

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@JasonShubnell |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||