|

|

25 November 2024 Case studies and the ETHBTC ratio |

| LMAX Digital performance |

|

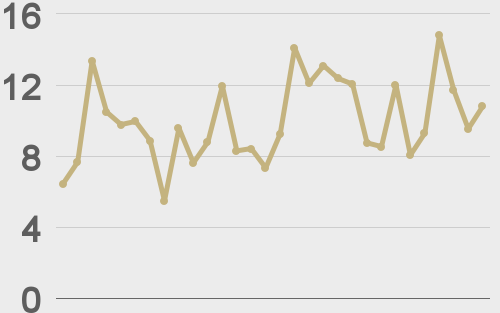

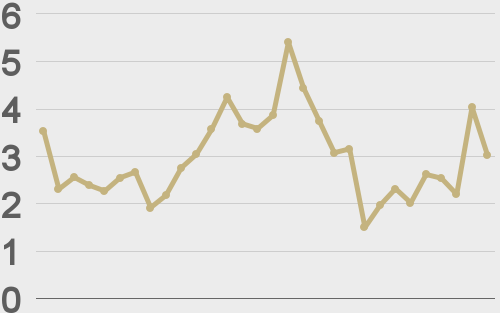

Total notional volume from last Monday through Friday came in at $5.5 billion, 15% lower than a week earlier. Breaking it down per coin, bitcoin volume came in at $3.4 billion, 26% lower than the previous week. Ether volume came in at $687 million, 20% lower than the week earlier. Total notional volume over the past 30 days comes in at $21.2 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,904 and average position size for ether at $3,100. Market volatility has trended higher in recent weeks. We’re looking at average daily ranges in bitcoin and ether of $3,250 and $166 respectively. |

| Latest industry news |

|

Bitcoin demand has been persistent and we continue to see the asset exceptionally well supported into dips as it keeps its focus on a breach of the massive $100,000 milestone. We’ve spent a lot of time talking about the major catalysts for the latest surge in demand including the US election, a technical breakout to fresh record highs beyond the March high, and the launch of bitcoin ETF options. We also think it’s well worth highlighting the positive momentum we’re seeing in the success of bitcoin accumulation strategies from the likes of MicroStrategy and El Salvador. One of the massive draws of bitcoin is the ability for the asset to scale. This opens the door for companies and nations to be thinking about taking on exposure. And now that these early examples of massive wins for MicroStrategy and El Salvador are making headlines around the world, we believe this sets the stage for more aggressive corporate and nation state adoption in 2025 and beyond. Moving on, another area of focus is on the ETHBTC ratio. This ratio has been hit hard since topping in 2021, with ETH under a great deal of pressure relative to bitcoin. With that said, we’re finally seeing ETH trading back down to a strong area of previous congestion from back in 2019 and 2020, which could be warning of a bounce. This times well with the anticipation of what should be a crypto friendly incoming US administration. Projects on Ethereum have suffered from a lack of a clear regulatory framework, which should now be forthcoming. If things play out this way, these projects should be in higher demand, which will bring more attention to Ethereum and prop up the price of ETH by extension. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

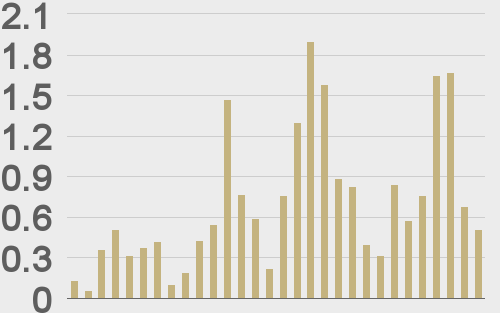

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||