|

|

18 July 2024 Considering crypto performance when US stocks are falling |

| LMAX Digital performance |

|

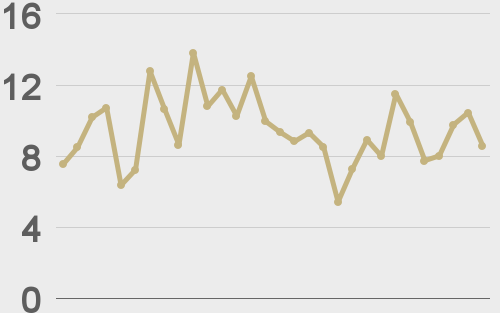

LMAX Digital volumes were mostly flat on Wednesday. Total notional volume for Wednesday came in at $360 million, 3% above 30-day average volume. Bitcoin volume printed $180 million on Wednesday, unchanged with 30-day average volume. Ether volume came in at $70 million, 41% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,455 and average position size for ether at $4,916. Market volatility is finally showing signs of turning back up after trending lower since March. We’re looking at average daily ranges in bitcoin and ether of $2,508 and $148 respectively. |

| Latest industry news |

|

One of the most interesting things about bitcoin is the fact that it has never had the benefit of trading in a bear market for US equities. Bitcoin was born out of a rejection of the traditional financial markets system. But since then, all we have seen is a US equities market that has continuously ascended to fresh record highs. The key point here is that bitcoin was designed as an extremely limited supply, deflationary asset, with all the properties and potential to be an attractive alternative store of value. And so, while we have seen periods of positive correlation between bitcoin and risk assets, this should not be construed as an absolute correlation. Indeed, because bitcoin is considered to be an emerging asset by many, it has shared correlations with risk assets. But as bitcoin matures and as global financial market conditions change, bitcoin will have an opportunity to realize its potential as a store of value. With that said, the outlook for bitcoin is exceptionally constructive both in a risk on market (as we have seen), where investors are still discovering and learning about bitcoin, and in a risk off market as it becomes attractive as a flight to quality. We’ve also highlighted the fact that in a period of risk off and lower stocks, other crypto assets are likely to underperform relative to bitcoin, as these assets are more risk correlated in nature. ETH is a currency that is built around web3 innovation and the future of decentralized finance and technology. And so, there is more risk built into ETH than there is with bitcoin. At the same time, because we are so early and the value proposition of ETH and other crypto assets is so attractive, we expect even ETH and other crypto assets to hold up relatively well through any period of sustained pullback in US and global equities. |

| LMAX Digital metrics | ||||

|

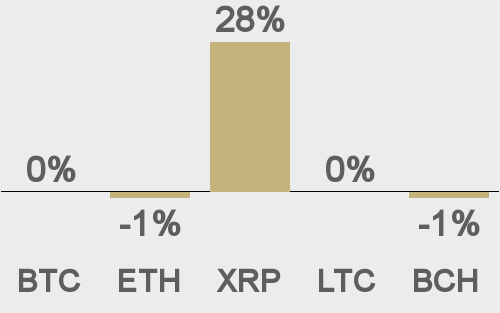

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

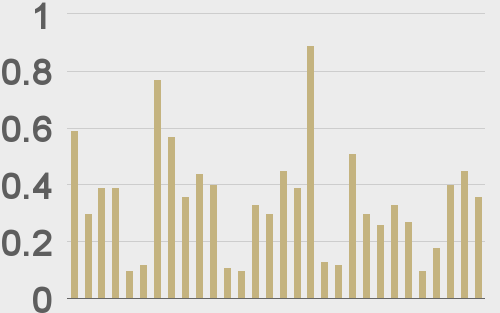

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

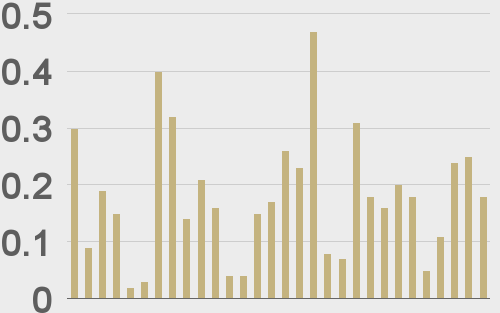

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

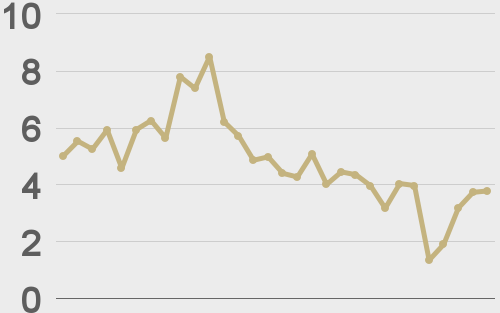

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||