|

|

6 February 2023 Correlations kick in on big moves |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was relatively flat in the previous week. Total notional volume from last Monday through Friday came in at $1.94 billion, 0.86% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $932 million in the previous week, down 13% from a week earlier. Ether volume however turned up, coming in at $555 million, 2.69% higher than the week earlier. Total notional volume over the past 30 days comes in at $11 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,137 and average position size for ether at $2,920. Volatility is finally showing signs of turning up from multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $744 and $70 respectively. |

| Latest industry news |

|

Correlations between crypto assets and traditional markets certainly turn up whenever there are pronounced moves. And this is how things have played out in recent sessions, with risk appetite coming off in a big way in the aftermath of last week’s FOMC decision and strong US economic data. Investors had been hoping the Federal Reserve would be looking to take its foot off the gas with respect to monetary policy tightenings. And while this may be the case, it isn’t looking like it will be enough to satisfy the market. The Fed has for the most part kept with its hawkish message, a message that is only reaffirmed when we get economic data like we saw out of the US on Friday. The jobs report was very strong, hourly earnings turned up year on year, and ISM non-manufacturing was better than forecast as well. All of this points to a US economy that is showing room for the growth cycle to extend in 2023. What this also does is take bets off the table around expectations for rate cuts in the second half of the year. And so, with rates not coming down as much as the market would like to see, stocks are suffering, yield differentials are moving back in the US Dollar’s favor, and cryptocurrencies are coming under pressure by extension. Technically speaking, after stalling out ahead of the August 2022 high, bitcoin could be getting set to roll back over for a retracement back down towards the $20k barrier. |

| LMAX Digital metrics | ||||

|

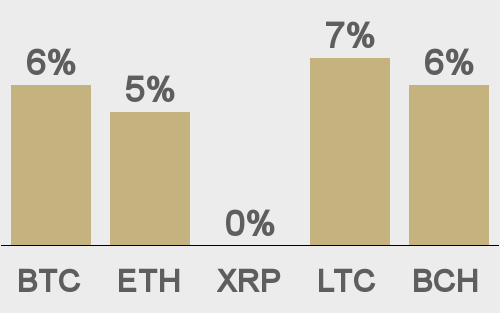

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

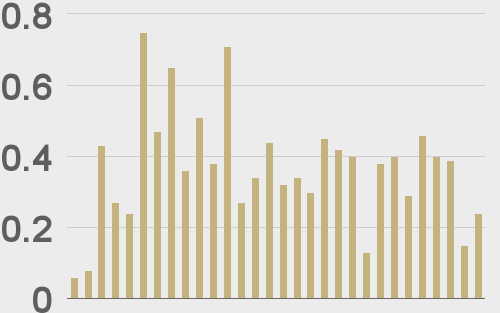

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

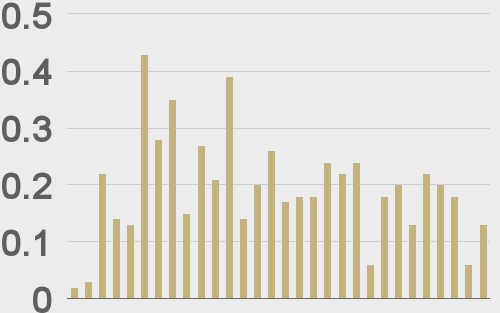

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

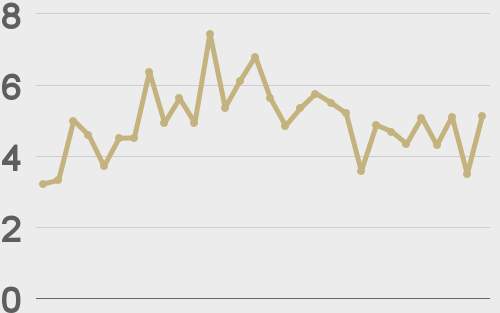

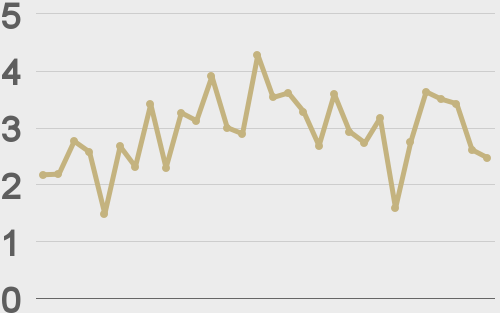

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||