|

|

15 April 2024 Crypto assets shake off weekend scare |

| LMAX Digital performance |

|

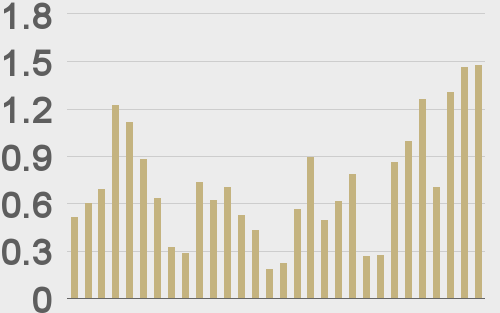

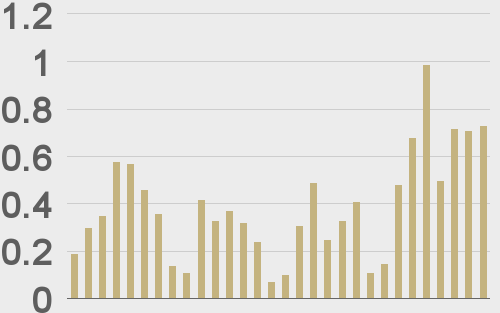

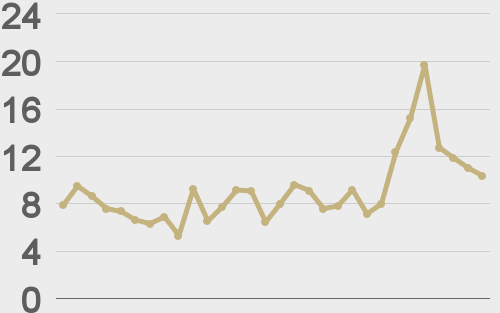

Total notional volume at LMAX Digital was impressive in the previous week. Total notional volume from last Monday through Friday came in at $5.1 billion, 53% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $3.4 billion in the previous week, 88% higher than the week earlier. Ether volume came in at $1.2 billion, 27% higher than the week earlier. Total notional volume over the past 30 days comes in at $21.8 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,341 and average position size for ether at $4,841. Market volatility has turned back up towards the multi-month peak levels from March. We’re looking at average daily ranges in bitcoin and ether of $3,563 and $221 respectively. |

| Latest industry news |

|

Before the week got going it was already off and running, with all of the geopolitical strain translating to a massive run of weekend volume. Total volume at LMAX Digital for Saturday and Sunday came in at nearly $3 billion. And market participants were able to breathe a sigh of relief as well, as fallout from the Iran-Israel conflict was negligible, with no major causalities reported. We’ve since seen crypto prices recover after initially making a scary Saturday dip on the news of Iran launching missiles at Israel. Technically speaking, despite the intense weekend dip, the bullish structure was never compromised, with bitcoin easily holding up above our highlighted $59k level of support. What’s also interesting is just how much more attractive crypto is becoming as an asset class, given the fact that it is a 24-7 market, which means liquid trading around major weekend event risk. There have been some other positives as well as the week gets going. For one thing, market participants are upbeat about the upcoming halving event at the end of this week. Another positive catalyst as the week gets going is the news Hong Kong has gone ahead and approved bitcoin and ether ETFs in an effort to become a leading crypto hub. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

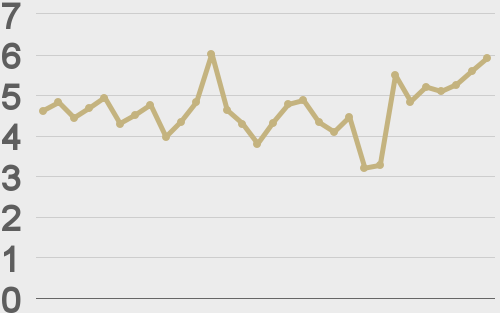

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||