|

|

28 December 2023 Crypto assets shine bright in 2023 |

| LMAX Digital performance |

|

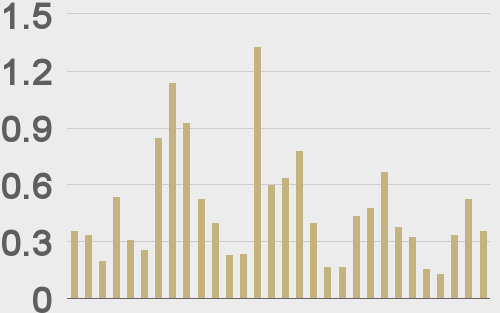

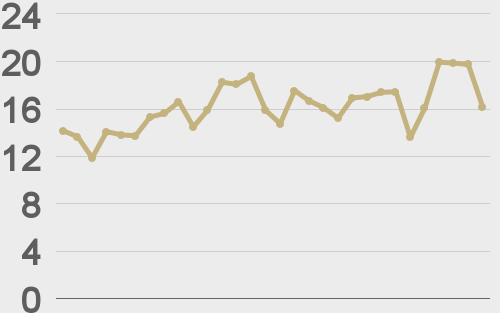

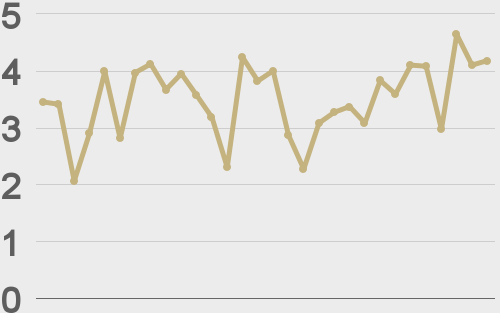

LMAX Digital volumes saw a mild decline in Wednesday’s thinner holiday trade. Total notional volume for Wednesday came in at $565 million, 9% below 30-day average volume. Bitcoin volume printed $360 million on Wednesday, 24% below 30-day average volume. Ether volume came in at $90 million, 1% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $16,108 and average position size for ether at $3,498. Bitcoin volatility has been trending just off yearly high levels set the other week, while Ether volatility has just run to its highest level in over a year. We’re looking at average daily ranges in bitcoin and ether of $1,441 and $98 respectively. |

| Latest industry news |

|

We’re into the final countdown of 2023 and it’s been a spectacular year for crypto assets. Year-to-date, both bitcoin and ether have exceeded returns of 100%. Bitcoin is up 183% year-to-date, and ether has just run up above 100% year-to-date. What makes all of this all the more impressive is that the performance comes on the back of a massive fallout in 2022 from all of the turmoil around major implosions, and in the face of intense regulatory scrutiny. But as we close out 2023, the outlook is very bright. What once seemed like it could be a near impossibility, is now looking like a certainty, with the SEC expected to go ahead and approve the bitcoin spot ETF applications in the early days of January. There are those who have expressed concern about a sell-off in bitcoin once the approvals are confirmed. While we acknowledge there could be some profit taking on a short-term basis, ultimately, this is a major event that should invite overwhelming demand into any dips. We think back to a 2022 Nasdaq survey of 500 financial advisors in the traditional markets space in which 72% of respondents said they would be more likely to invest in crypto if spot ETFs were approved in the US. We suspect that poll would produce an even higher percentage result a year later in light of 2023 performance. And so, as the year comes to a close, the stage is set for what should be a very exciting year for the crypto asset class in 2024. Mainstream sentiment is changing in a positive way and when this money comes flowing in, crypto assets should shine even brighter. |

| LMAX Digital metrics | ||||

|

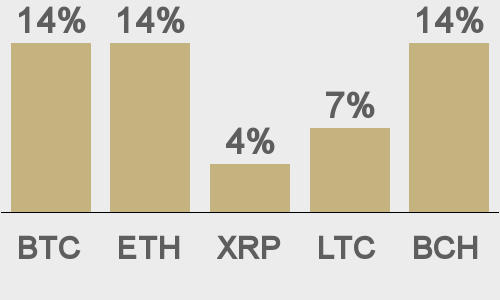

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

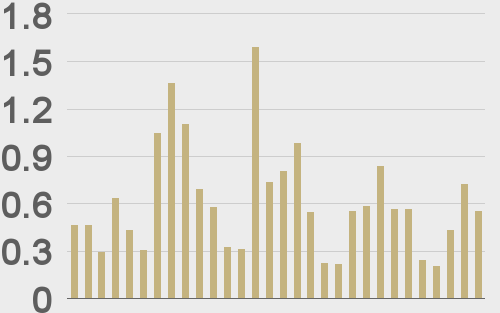

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||