|

| 11 August 2025 Crypto cools after weekend heat |

| LMAX Digital performance |

|

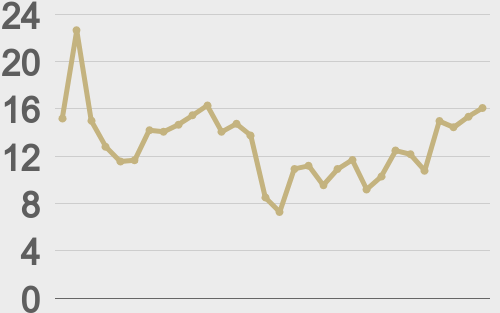

Total notional volume from last Monday through Friday came in at $2.2 billion, 29% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $820 million, 45% lower than the previous week. Ether volume came in at $859 million, 1% lower than the week earlier. Total notional volume over the past 30 days comes in at $18.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,771 and average position size for ether at $2,910. Bitcoin volatility continues to track just off yearly low levels. ETH volatility has been trending up since bottoming in May, at its highest levels since March. We’re looking at average daily ranges in bitcoin and ether of $2,671 and $191 respectively. |

| Latest industry news |

|

Crypto markets are seeing a bout of Monday profit-taking after an impressive weekend surge that lifted Bitcoin back above $120K and within striking distance of its recent record high, while Ethereum extended its rally to a new yearly peak. ETH now sits just shy of its 2021 all-time high of $4,870. It’s possible a lot of this profit taking also has something to do with a market that doesn’t want to get caught overly long ahead of tomorrow’s U.S. CPI data. The White House saw a shake-up as Bo Hines, the crypto council director under Trump’s administration, stepped down to return to the private sector. While the exit garners attention, the broader regulatory landscape remains supportive of crypto, as Hines’s successor—likely Patrick Witt—is expected to continue the pro-digital-assets posture. In Latin America, El Salvador passed a new Investment Banking Law empowering licensed banks with $50M+ in capital to hold Bitcoin and offer crypto services to sophisticated and institutional clients. This marks a notable step toward mainstreaming digital assets in financial systems. Meanwhile, institutional flows remain strong. Corporate treasuries and U.S. spot Bitcoin ETFs are absorbing capital steadily, underpinning BTC’s latest rally. At the same time, a shift in safe-haven preference appears underway. U.S. tariffs on Swiss gold bars, followed by policy backtracking, have exposed fragility in gold’s stronghold. Bitcoin’s appeal as a borderless, tariff-free store of value is gaining fresh traction, especially as gold grapples with supply bottlenecks and policy risk. |

| LMAX Digital metrics | ||||

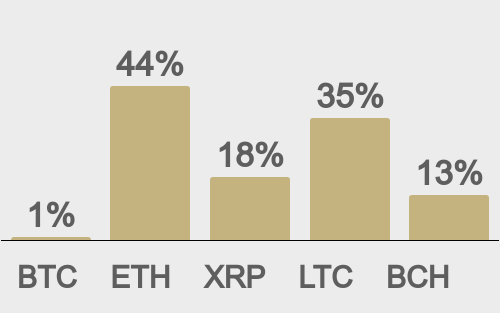

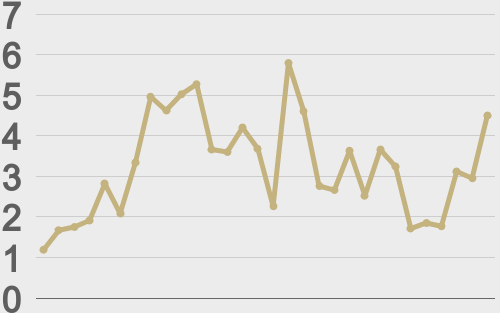

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

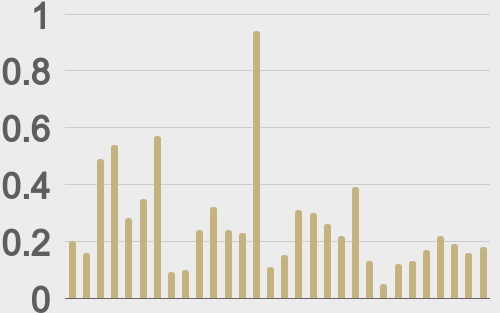

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||