|

|

27 July 2023 Crypto gets boost from Fed decision |

| LMAX Digital performance |

|

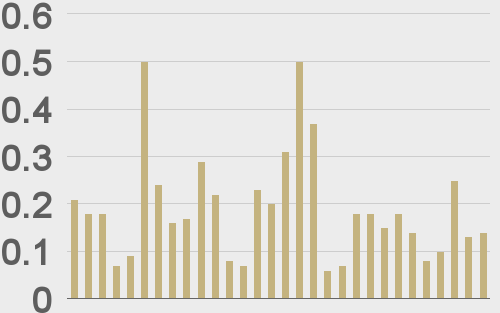

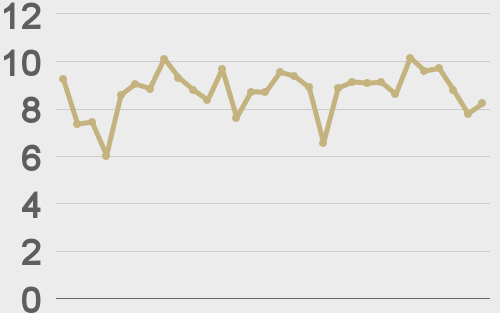

LMAX Digital volumes improved on Wednesday after an anemic Tuesday performance. Nevertheless, with trading ranges still quite tight, total volume continues to trend below 30-day average volume. Total notional volume for Wednesday came in at $245 million, 26% below 30-day average volume. Bitcoin volume printed $138 million on Wednesday, 28% below 30-day average volume. Ether volume printed $75 million, 11% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,789 and average position size for ether at $3,050. Volatility is tracking near the lower bound of this year’s range. We’re looking at average daily ranges in bitcoin and ether of $731 and $51 respectively. |

| Latest industry news |

|

Investors continue to question the Fed outlook of higher for longer monetary policy, instead pushing for a more accommodative path going forward. This has opened broad based US Dollar outflows in the aftermath of the Fed decision, with bitcoin and the broader crypto market benefiting as a consequence. At the same time, the bitcoin rally has been rather mild and needs to be taken with a grain of salt. Ultimately, bitcoin will need to establish back above the $30,500 area to take the immediate pressure off the downside and suggest we’re seeing legitimate bullish momentum. Looking ahead, it will take some more sessions before the Fed decision is fully digested. We’re concerned the market has been overly optimistic, setting up the possibility for a letdown and reversal of flow. On the crypto side, a lot of the focus will be on waiting to see what comes of the bitcoin ETF decision and whether or not the SEC goes ahead and approves the BlackRock application. We believe this could be the catalyst for the next big move in the crypto market and are optimistic the ETF will finally be greenlighted, opening the door for a bullish breakout. Another positive for the space comes from stablecoin supply metrics which are repeating historical bull market patterns. These metrics reflect a bitcoin market in peak accumulation mode, which often warns of a big rally ahead. |

| LMAX Digital metrics | ||||

|

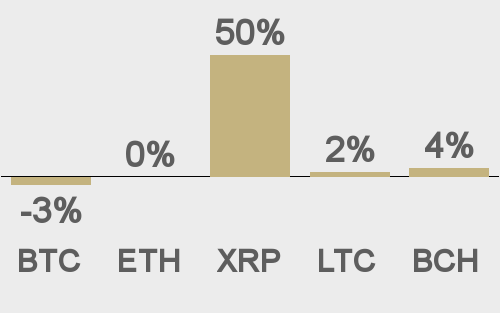

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

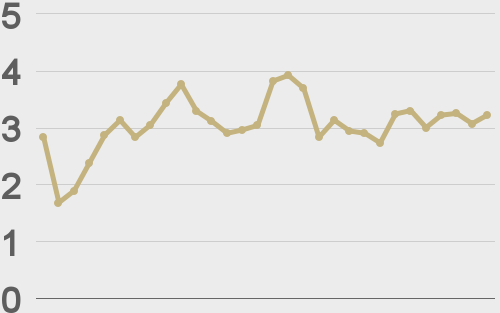

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||