|

| 9 September 2025 Crypto holding the line, eyes brighter Q4 |

| LMAX Digital performance |

|

LMAX Digital volumes were on the lighter side to start this week. Total notional volume for Monday came in at $460 million, 18% below 30-day average volume. Bitcoin volume printed $196 million, 18% below 30-day average volume. Ether volume came in at $133 million, 37% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,906 and average position size for ether at $3,602. Bitcoin volatility continues to consolidate off yearly low levels. ETH volatility has been in cool down mode since recently hitting its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $2,626 and $195 respectively. |

| Latest industry news |

|

The crypto market has held modestly firm over the past 24 hours, with bitcoin once again acting as the key proxy for broader sentiment. After some mild downside pressure linked to ongoing Israel–Iran geopolitical tensions, the market has shown resilience, shrugging off those risks in favor of dip-buying from institutional players. Ethereum has also attracted solid demand, supported by robust ETF inflows which continue to provide a reliable floor despite short-term outflows. Its appeal as a yield-generating asset, alongside continued Layer-2 expansions, has further bolstered sentiment. DeFi lending volumes doubling year-to-date and the growth of tokenized U.S. stocks expanding access for emerging markets are helping position ETH as a central beneficiary of the blending between TradFi and blockchain. Traditional market drivers remain front and center, with the Fed dominating the macro backdrop. Last Friday’s soft U.S. jobs report effectively locked in a rate cut for the September 17 FOMC meeting, with implied probability now priced at an extraordinary 112%. While some chatter around a 50bps move has emerged, our base case remains a steadier sequence of 25bps in September, followed by 25bps in both October and December. Thursday’s U.S. CPI print will be the next pivotal test, though even an upside surprise might not be enough to meaningfully shift expectations given the labor market slowdown. Finally, seasonality remains a live risk factor. Bitcoin has gained around 2.5% month-to-date, but September is historically the weakest month of the year, averaging -3.9% since 2016. While both 2023 and 2024 bucked the trend with positive Septembers, the high level of market commentary on this seasonal dynamic raises the risk of positioning complacency. With sentiment oscillating between institutional dip-buying and whale liquidation, the coming weeks may well determine whether this year’s September again defies history—or reverts to type. The good news is that October and Q4 have historically been the strongest months for bitcoin and crypto performance, offering scope for a more constructive setup as we move towards year end. |

| LMAX Digital metrics | ||||

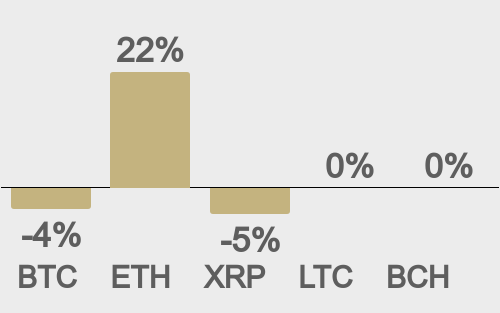

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

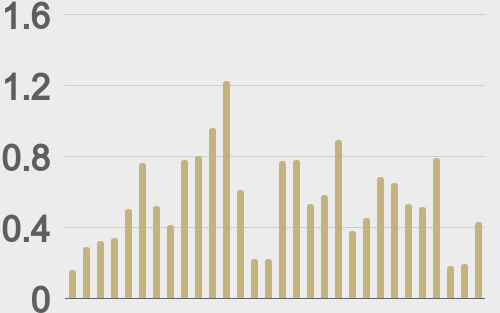

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

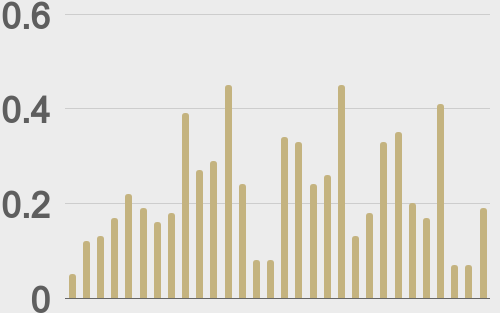

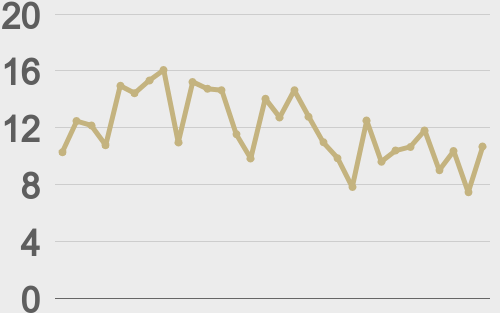

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

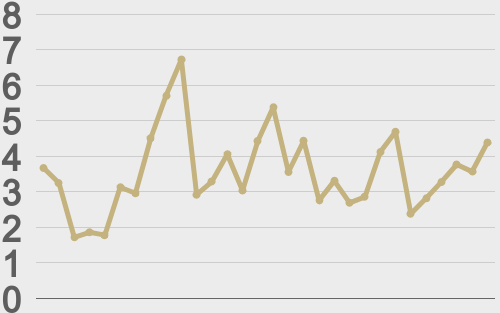

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||