|

|

17 May 2023 Crypto holds up relatively well |

| LMAX Digital performance |

|

LMAX Digital volumes pulled back some more on Tuesday. Total notional volume for Tuesday came in at $345 million, 23% below 30-day average volume. Bitcoin volume printed $230 million on Tuesday, 13% below 30-day average volume. Ether volume printed $69 million, 44% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,598 and average position size for ether at 2,808. Volatility has been trending lower in correction mode after peaking out at a yearly high in March. We’re looking at average daily ranges in bitcoin and ether of $913 and $66 respectively. |

| Latest industry news |

|

Crypto assets held up relatively well on Tuesday considering a wave of broad based US Dollar demand and risk off flow. On Tuesday, we got an on the whole solid US retail sales print (despite the discouraging headline number), along with some more hawkish Fed speak, which was seen driving most of the activity. And yet, we believe risk associated with the US banking system and added concerns around the US debt ceiling are translating to a positive spotlight on cryptocurrencies as an attractive alternative. Of course, the regulatory uncertainty in crypto remains a thorn at the side of the asset class, and more headway will be needed on this front to ramp up optimism and fuel a fresh wave of momentum. Having said that, we do continue to see ongoing evidence of institutional interest in the crypto market, despite a milder period of institutional demand for added exposure to bitcoin and ether. Some of the latest headlines are around River Financial’s raise of $35 million Series B funding, and an all-in-one crypto financial services platform’s partnership with an established custodian to offer prime brokerage services to its clientele. Technically speaking, as highlighted in today’s chart update, while above last Friday’s low, the focus can remain on the topside, with the idea that bitcoin could be getting ready to turn back up after testing multi-day consolidation support. Back below last Friday’s low will however change the short-term picture and open the possibility for a deeper slide towards $22,000. |

| LMAX Digital metrics | ||||

|

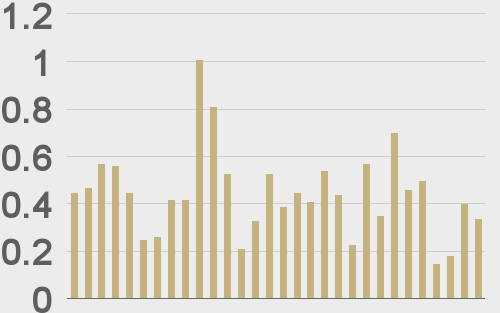

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

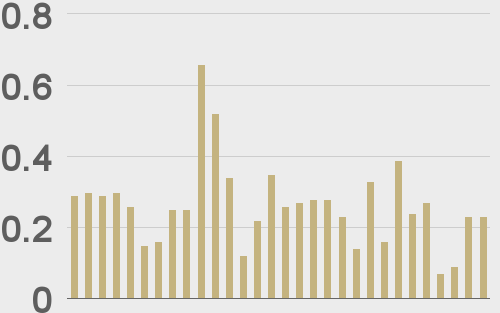

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

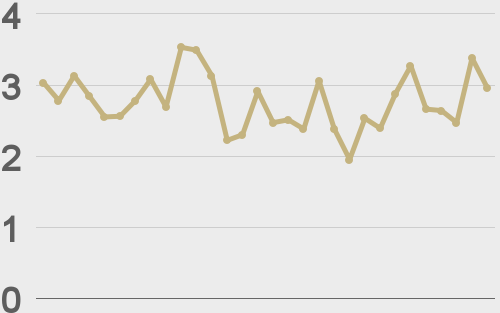

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||