|

|

26 July 2023 Crypto market braces for Fed impact |

| LMAX Digital performance |

|

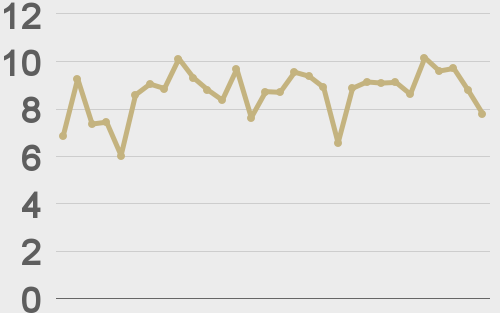

LMAX Digital volume cooled off Tuesday on account of tight range trade into today’s central bank event risk. Total notional volume for Tuesday came in at $198 million, 42% below 30-day average volume. Bitcoin volume printed $125 million on Tuesday, 35% below 30-day average volume. Ether volume came in at $43 million, 49% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,702 and average position size for ether at 2,997. Volatility has traded down towards yearly low levels after an impressive run higher in June. We’re looking at average daily ranges in bitcoin and ether of $751 and $53 respectively. |

| Latest industry news |

|

The big focus for the day is the Fed decision, reaction in US equities, and how this translates in the world of crypto. Indeed, correlations with risk sentiment have been less relevant in recent weeks. Stocks have enjoyed an impressive run to the topside, all while crypto assets have been unwilling to participate. At the same time, we’re concerned the same may not apply should stocks reverse course and head south. Technically speaking, we’ve highlighted a break of multi-day consolidation support which opens the door to the possibility for deeper setbacks in the price of bitcoin towards $25k. Fundamentally, with crypto still viewed by many as a maturing, emerging asset class, there is risk a post-Fed decision fallout in equities could very well weigh on crypto assets. There is already some added pressure on the crypto space on the news of digital asset funds witnessing weekly outflows of $6.5 million after gaining $742 million of inflows through the previous four weeks. Of course, the market is also waiting on an approval of the BlackRock ETF, something that would likely more than offset any downside and invite a fresh wave of significant demand for bitcoin and other crypto assets. Also worth keeping an eye on is news around PacWest and a Wall Street Journal report that the bank’s massive share decline was partly due to the merger with smaller rival Banc of California. Remember, earlier this year, all of the troubles in the banking system served as a positive catalyst for crypto assets. If this story comes back into play, it could once again inspire demand for cryptocurrencies. |

| LMAX Digital metrics | ||||

|

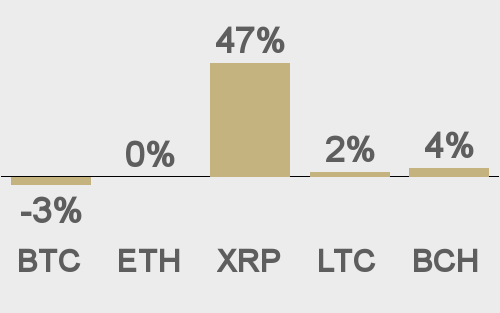

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

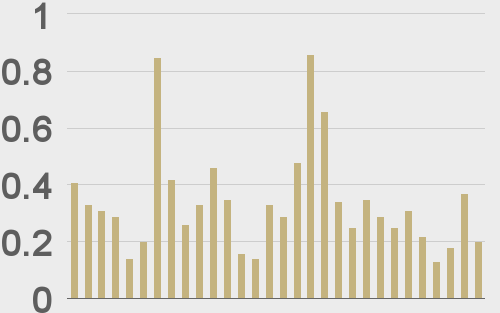

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

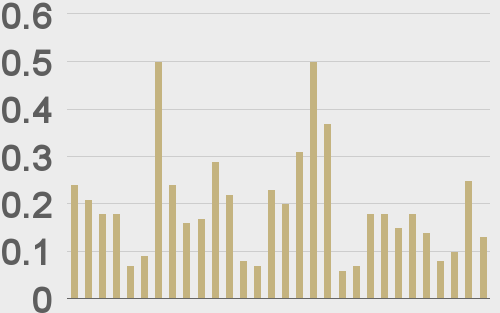

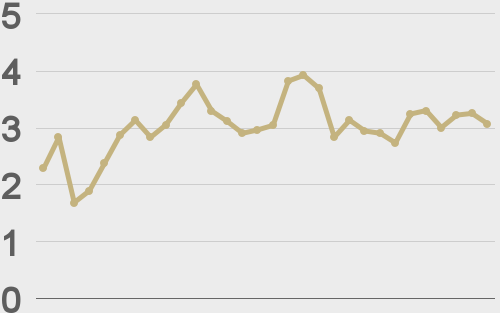

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||