|

|

17 August 2022 Crypto more sensitive to currencies than stocks |

| LMAX Digital performance |

|

LMAX Digital volumes held steady overall in Tuesday trade. Total notional volume for Tuesday came in at $458 million, 1% above 30-day average volume. Bitcoin volume printed $258 million on Tuesday, 6% below 30-day average volume. Ether volume came in at $176 million, 23% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,278 and average position size for ether at 2,983. Volatility has been absent from the market for much of 2022 and is still trending down at yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $1,019 and $115 respectively. |

| Latest industry news |

|

The interesting thing about crypto markets right now is that they are less focused on US equities and a whole lot more interested in the US Dollar. Stocks have been rallying quite a bit, all while bitcoin and eth continue to track mostly sideways. We attribute this to a currency market that is still very worried about the global growth and Fed rate outlook, which has resulted in risk off (currency) flow into the US Dollar. And if the US Dollar is going up across the board, bitcoin and ether are suffering. As far as updates in the crypto space go, they’ve actually been mostly positive of late. Volumes are picking up, there is evidence of fresh institutional demand, and companies are getting approval to offer crypto services to customers across the EU. We’ve also heard from Singapore where the courts have granted beleaguered crypto exchange Zipmex more than three months of creditor protection so that the company can devise a funding plan. Looking ahead, a lot of the focus will be on the Fed Minutes due later today. If the Fed Minutes are percieved to be hawkish leaning by the market, this could open downside pressure on crypto. If on the other hand the Minutes are less hawkish than expected, we could see bitcoin and ether trying to break higher. |

| LMAX Digital metrics | ||||

|

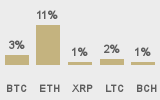

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||