|

|

27 February 2023 Crypto outperforms other major assets |

| LMAX Digital performance |

|

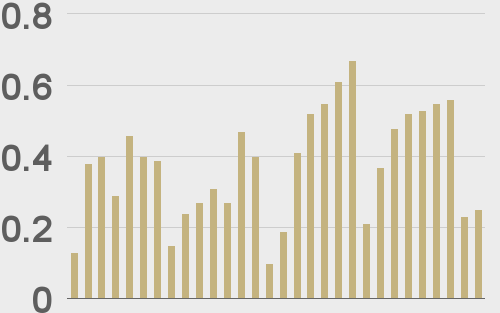

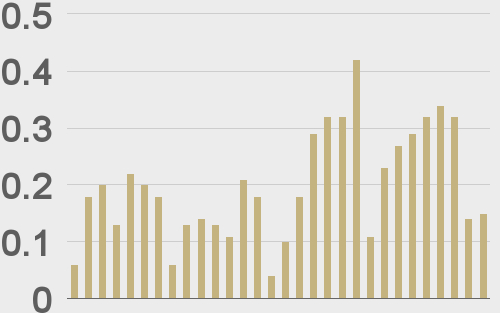

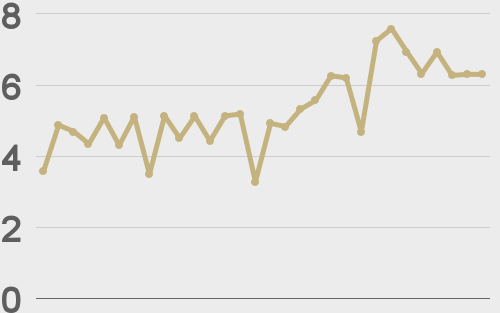

Total notional volume at LMAX Digital was off marginally in the previous week from a week earlier. Total notional volume from last Monday through Friday came in at $2.6 billion, 4.3% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.5 billion in the previous week, slightly exceeding volume from a week earlier. Ether volume came in at $653 million, 20% lower than the week earlier. Total notional volume over the past 30 days comes in at $11.3 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,519 and average position size for ether at $3,026. Volatility has turned up in recent weeks and is well off multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $892 and $68 respectively. |

| Latest industry news |

|

When we look at performance in global markets over the past month, it’s clear we’re seeing a very resilient crypto asset class shining through. Over the past 30 days, currencies, commodities, and stocks, are all down against the US Dollar, while bitcoin and ether are actually up over that time. Ether is up nearly 5%, while bitcoin is up nearly 3%. We believe most of the outperformance comes from news of ongoing institutional adoption, with these larger market participants finally stepping in to take on and build into existing exposures. Having said that, crypto assets are not completely immune to the big picture stuff going on. That is to say, a repricing of Fed expectations, resulting in higher US rates and less investor friendly monetary policy, is likely to weigh on crypto should we continues to see downside pressure on risk assets like we’ve been seeing in recent days. Technically speaking, bitcoin’s topside failure into critical resistance in the $25k area is yet another sign that over the short-term, there could be additional downside pressure before we see the market find its feet. |

| LMAX Digital metrics | ||||

|

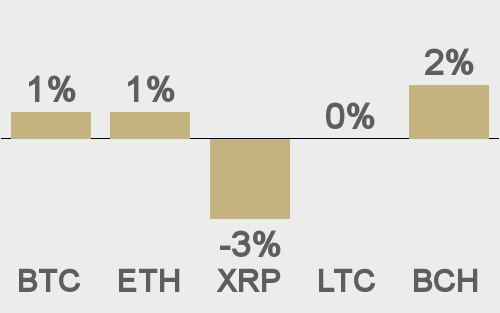

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

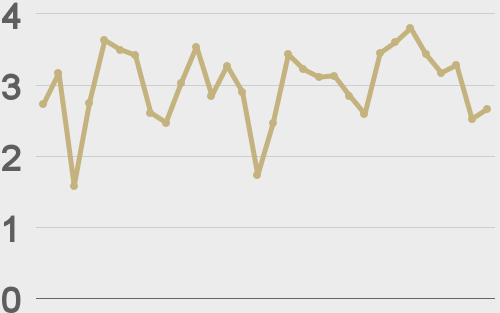

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||