|

|

22 March 2023 Crypto readies for Fed decision |

| LMAX Digital performance |

|

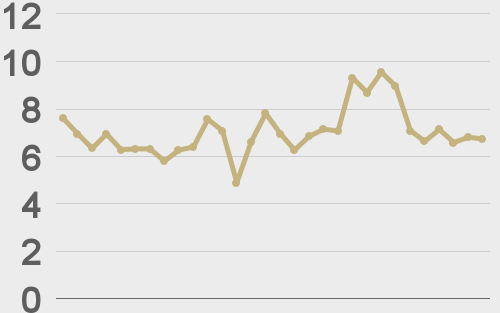

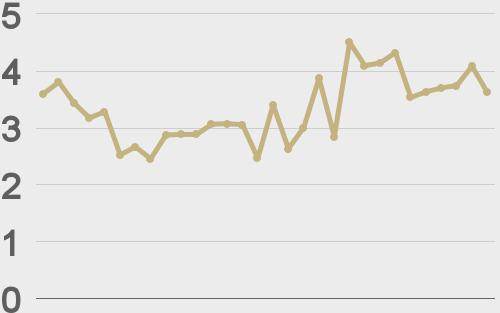

LMAX Digital volumes paused for a bit of a breather on Tuesday after several days of impressive prints. Still, overall volume continued to hold above 30-day average volume. Total notional volume for Tuesday came in at $512 million, 3% above 30-day average volume. Bitcoin volume printed $287 million on Tuesday, 5% below 30-day average volume. Ether volume printed $141 million, 20% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,168 and average position size for ether at 3,403. Volatility has turned up nicely in recent sessions, trading to a fresh yearly highs. We’re looking at average daily ranges in bitcoin and ether of $1,236 and $84 respectively. |

| Latest industry news |

|

Bitcoin continues to be very well supported on any form of a dip after trading up to a nine-month high on Tuesday. The recent turmoil in the banking system, both in the US and abroad, has served as a serious prop for the decentralized, limited supply currency. The major central banks have now been tasked with the responsibility of solving the issue of liquidity in the banking system and a lot of this has also translated to money printing gestures that only further support the idea of diversification into bitcoin. Attention now turns to today’s Fed policy decision, which is likely to have an impact on crypto assets. As things stand, if the Fed delivers a more dovish than expected decision and communication, it will fuel additional US Dollar outflows and benefit bitcoin as a consequence. Interestingly enough, if the Fed delivers a more hawkish leaning decision, it could also be a benefit to bitcoin, as it only gets the market that much more uncomfortable about the state of global risk assets. The point here is that we are starting to see signs of flight to quality translating to flight to bitcoin. Of course, we’re not completely there just yet, and it’s still possible that anything leaning hawkish will weigh on stocks and filter over into some downside pressure on bitcoin and other crypto assets. Technically speaking, setbacks should be well supported now by previous resistance in the $25k area, while the next big target above comes in the form of the psychological barrier at $30k. |

| LMAX Digital metrics | ||||

|

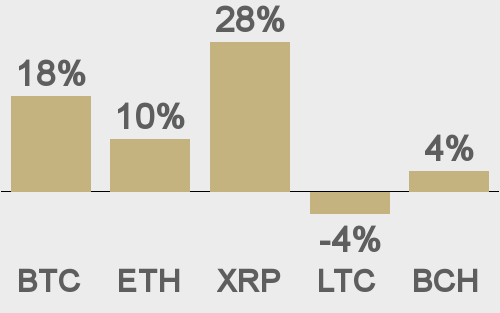

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

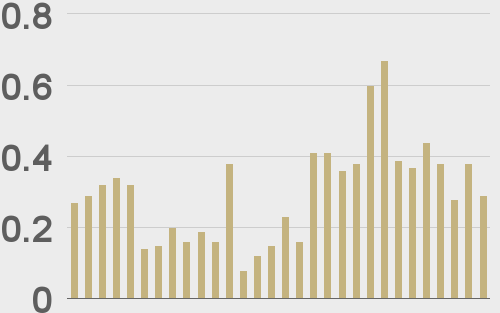

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||