|

| 24 June 2025 Crypto rebounds on hope for ceasefire |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a solid start this week. Total notional volume for Monday came in at $570 million, 33% above 30-day average volume. Bitcoin volume printed $248 million, 26% above 30-day average volume. Ether volume came in at $151 million, 38% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,932 and average position size for ether at $2,867. Bitcoin volatility is slowly turning up from yearly low levels, while ETH volatility has been contained since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $3,155 and $146 respectively. |

| Latest industry news |

|

The cryptocurrency market has staged a healthy recovery over the past several hours, driven by a shift to risk-on sentiment following President Trump’s announcement of a tentative ceasefire between Israel and Iran. Despite ongoing Iranian missile strikes, the prospect of de-escalation in the Middle East has reduced geopolitical risk premiums, boosting bitcoin and ETH, as markets price in reduced volatility. In traditional markets, dovish signals from Federal Reserve officials, including comments from Fed Governor Bowman and Chicago Fed President Goolsbee, have fueled expectations of rate cuts as early as July 2025, particularly as May CPI data is expected to ease. Softer U.S. economic data, such as a slightly weaker June flash PMIs supports the case for a more accommodative Fed policy, enhancing liquidity and driving capital into cryptocurrencies. This macro backdrop, combined with a declining US Dollar, has further supported bitcoin and ETH. Within the crypto ecosystem, institutional interest remains a key catalyst. Meanwhile, New Hampshire, Texas, and Arizona have all been making moves to build bitcoin exposure in 2025. New Hampshire became the first state to establish a strategic bitcoin reserve, and this has been followed up by Texas, after the Governor signed a Bill for a State Reserve. Arizona has recently voted to revive its bitcoin reserve Bill. Spot Bitcoin ETF inflows continue to provide structural support, while Ethereum’s on-chain activity has spiked, with a healthy pickup in daily transaction volume, reinforcing bullish momentum as investors anticipate further adoption. Additional positive catalysts include the CME Group’s planned launch of XRP futures, which could deepen liquidity and attract institutional players, and corporate accumulation trends, such as ProCap Financial’s plan to hold up to $1 billion in bitcoin. Looking ahead, traders should monitor Fed Chair Powell’s testimony today and upcoming PCE data for further clues on rate cut timing, as these will likely dictate near-term crypto volatility. |

| LMAX Digital metrics | ||||

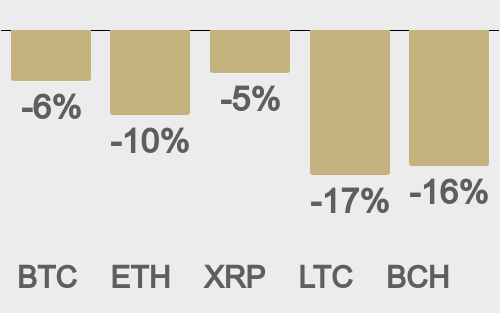

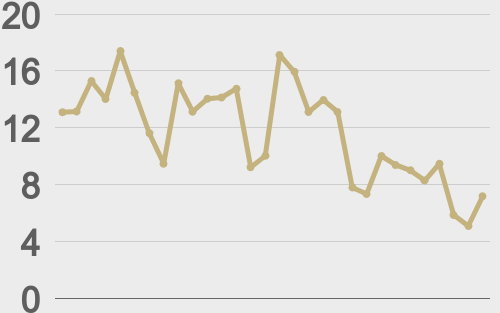

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

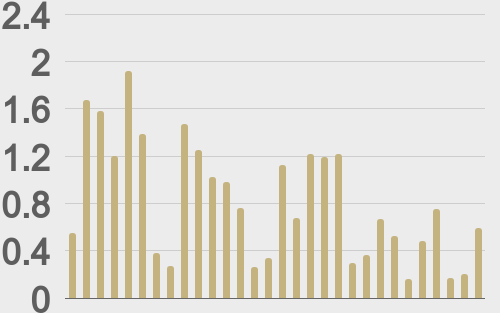

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

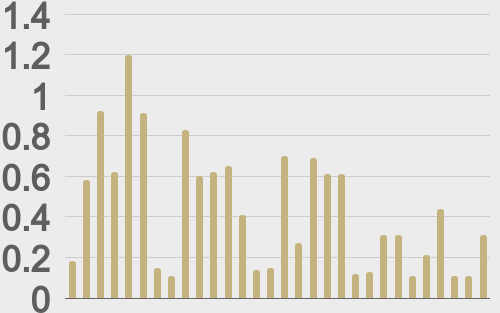

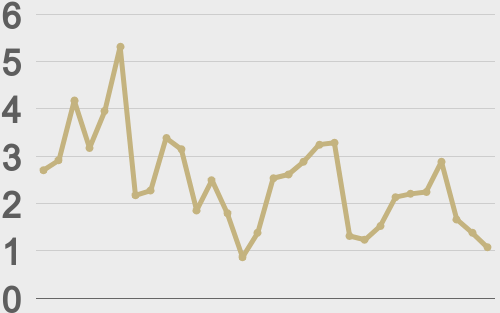

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||