|

|

4 April 2022 Crypto resilient despite setbacks |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was off marginally in the previous week. Total notional volume from Monday through Friday came in at $3.48 billion, just 4% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $2.1 billion in the previous week, off 9% from a week earlier. Ether volume came in at $1 billion, up 6% from the week earlier. Total notional volume over the past 30 days comes in at $17.9 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,441 and average position size for ether at $5,381. Volatility has cooled off in 2022 after topping out in December. We’re now looking at average daily ranges in bitcoin and ether of $1,776 and $150 respectively. |

| Latest industry news |

|

Last week, the EU parliament voted in favor of passing stringent AML laws that would require centralized crypto exchanges to report any transaction in which a customer sent or received crypto to or from a self-custody wallet, whether or not the user owned the self-custody wallet. The law has yet to be passed, but is clearly a negative when it comes to the EU embracing crypto innovation. This could force many crypto business out of the region. At the same time, given adoption in the EU has been mild as compared to the rest of the world, fallout from this news has been negligible. Another setback in the crypto space right now is around security risk. We have seen many hacks in recent days and it’s clear there need to be better solutions to protect users against such risk. Most of the attacks are however coming from web2 attack vectors rather than via web3 software, which has been somewhat encouraging. Overall, activity continues to be quite mild in crypto markets, despite recent demand. We believe the market could be more cautious right now, with sensitivity to traditional risk assets still there and potential for US equities to roll over and weigh on crypto, should we see another downturn in global risk sentiment. Still, the short-term technical outlook has been more constructive, with bitcoin consolidating and possibly considering the next upside extension towards $53,000. Certainly seasonal trends are in crypto’s favor, with April proving to be the strongest month on record since 2017. |

| LMAX Digital metrics | ||||

|

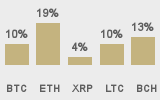

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

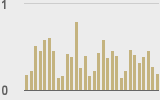

Total volumes last 30 days ($bn) |

||||

|

||||

|

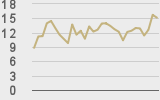

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

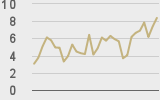

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||