|

|

8 February 2024 Crypto shining brighter than red hot US equities |

| LMAX Digital performance |

|

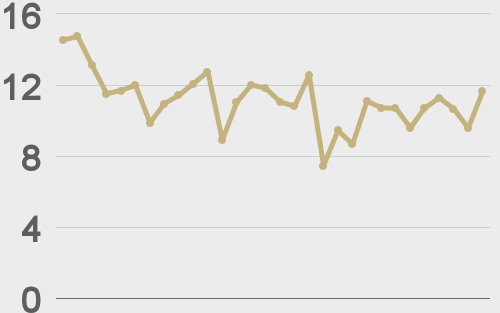

LMAX Digital volumes improved from Tuesday levels and are showing signs of picking up as short-term ranges are broken. Total notional volume for Wednesday came in at $406 million, 24% below 30-day average volume. Bitcoin volume printed $236 million on Wednesday, 36% below 30-day average volume. Ether volume bucked the trend for the second consecutive day, coming in at $124 million, 12% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,021 and average position size for ether at $3,434. Volatility has come down by about 45% since peaking at multi-month highs in January. We’re looking at average daily ranges in bitcoin and ether of $1,345 and $81 respectively. |

| Latest industry news |

|

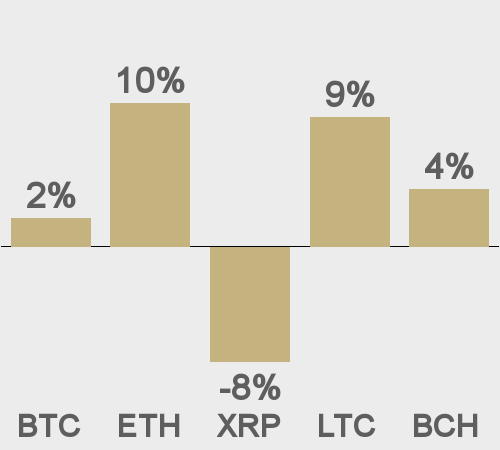

There’s been a lot of attention in financial markets around the S&P 500’s run to a fresh record high. And when it comes to performance in traditional assets over the past 30 days, US equity market strength certainly stands out. But if we look at crypto market performance relative to US equities, things have been even more impressive. Ether has been a major outperformer, up more than double the S&P 500 over the past 30 days, with gains exceeding 10%. Bitcoin gains have been more mild but are also positive over this time frame. It makes sense to see ether outperforming bitcoin in a market environment where risk appetite is looking healthy and stocks are running to record highs. Of the two cryptocurrencies, ether is the one that is more similar to stocks when it comes to the value proposition. There are other factors behind ether outperformance as well. These include the news of ARK filing an amended S-1 for its spot ETH ETF application, and the Ethereum network progressing with the deployment of the Dencun upgrade. As far as bitcoin ETF updates go, things have also been encouraging. Grayscale’s GBTC recorded its sixth consecutive day of shrinking outflows, while ETF funds overall recorded the eighth consecutive day of inflows. Technically speaking, bitcoin has broken out of a range and could be looking for a push to a fresh yearly high through $50k. At the moment, our biggest concern with respect to the shorter-term outlook is the risk for a major reversal in US equities. Indeed, cryptocurrencies have been less correlated to stocks in recent months. At the same time, should we see an intense turnaround, it could open the door for a pullback. The good news here is that if we do see pullbacks in crypto from weakness in stocks, these dips are expected to be well supported for fresh demand as medium and longer-term players look to take advantage. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

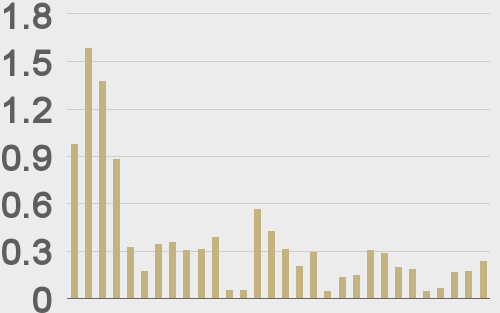

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

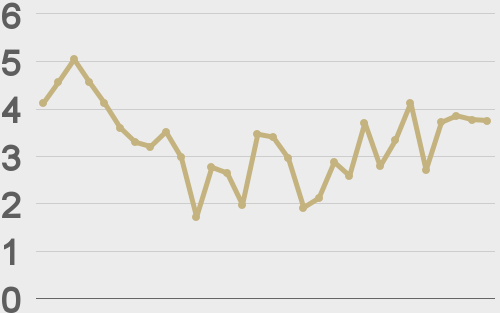

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||