|

| 10 December 2025 Crypto shrugs off macro ahead of Fed decision |

| LMAX Digital performance |

|

LMAX Digital volumes improved from Monday but were still on the lighter side overall on Tuesday. Total notional volume came in at $345 million, 27% below 30-day average volume. Bitcoin volume printed $212 million, 24% below 30-day average volume. Ether volume came in at $69 million, 37% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,982 and average position size for ether at $2,106. Volatility has come down since trading to multi-month highs in October. We’re looking at average daily ranges in bitcoin and ether of $3,576 and $182 respectively. |

| Latest industry news |

|

As we head into Wednesday, crypto assets continue to exhibit notable relative strength versus traditional risk markets, with bitcoin serving as the clear proxy for the broader complex. Price action has remained resilient despite mixed equity performance, underscoring that recent gains have been driven less by global risk appetite and more by crypto-specific catalysts. In particular, ongoing regulatory clarity narratives and continued institutional engagement have reinforced the market’s view that structural demand is improving independently of macro conditions. This divergence has highlighted that crypto is increasingly moving on its own fundamentals rather than traditional risk flows. Bitcoin has benefited from a steady bid tied to pro-crypto policy signals, improved market infrastructure, and sustained inflows into regulated investment vehicles. These developments have helped insulate bitcoin from near-term volatility in rates and equities. Investors remain cautious across traditional markets amid uncertain central bank timing and mixed economic data, but bitcoin is increasingly being treated as a standalone allocation rather than a high-beta extension of tech equities. That reframing has supported resilience even during softer equity sessions. ETH has outperformed bitcoin over recent sessions, reflecting growing investor confidence in activity beyond store-of-value dynamics. Rising network usage, traction in tokenization, and optimism around institutional on-chain adoption have all supported this relative strength. This ETH outperformance is constructive for the asset class as a whole, signaling incremental capital is beginning to express views outside of bitcoin alone. Broadening participation tends to reinforce healthier market structure and deeper liquidity across tokens. From a macro perspective, traditional markets remain focused on the path of inflation, interest rates, and geopolitics, including ongoing trade and election-related uncertainty. These factors have constrained equity upside and kept volatility elevated. Crypto markets, however, appear to be less directly impacted at present, benefiting instead from idiosyncratic tailwinds and sector-specific news flow. That divergence has reinforced the perception of crypto as a distinct risk bucket with its own demand drivers. Overall, the combination of bitcoin resilience and ethereum leadership presents a constructive near-term backdrop for digital assets. Sustained ETH outperformance relative to bitcoin is particularly notable, as it suggests broadening investor engagement across the ecosystem. Should crypto-specific momentum persist alongside a stabilizing macro environment, relative performance versus traditional assets is likely to remain favorable, though near-term direction will be shaped by broader risk sentiment as all eyes now turn to the Federal Reserve’s policy decision. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

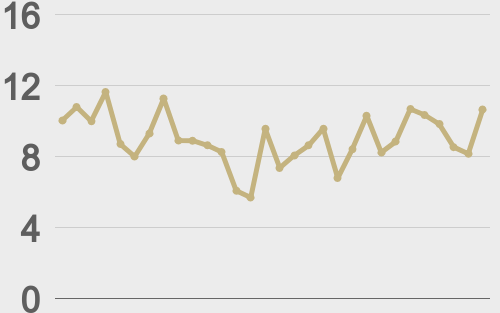

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||