|

| 13 October 2025 Crypto steadies as oracle shock fades |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $4.1 billion, improving 14% from a week earlier. Breaking it down per coin, bitcoin volume came in at $1.9 billion, 13% higher than the previous week. Ether volume came in at $1.2 billion, 18% higher than the week earlier. Total notional volume over the past 30 days comes in at $18.7 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,768 and average position size for ether at $3,449. Bitcoin volatility has shot up in recent days, while ETH volatility is trending back towards recent peak levels. We’re looking at average daily ranges in bitcoin and ether of $3,853 and $271 respectively. |

| Latest industry news |

|

Bitcoin and the broader crypto market endured one of the sharpest sell-offs in years late last week, initially pressured by risk-off flows tied to renewed global trade tensions. That weakness was then amplified by the oracle malfunction that triggered a wave of forced liquidations across leveraged positions — an unprecedented event in scale that left even seasoned market participants rattled. At the lows, both bitcoin and ETH were down sharply, with liquidity tested across major exchanges. Since then, however, the market has shown resilience. Into Monday, both bitcoin and ETH have retraced a meaningful portion of their losses, with investors encouraged by the ability of systems to stabilize after the oracle shock. Bitcoin reclaimed levels above key technical markers, while ETH is attempting to re-establish back above $4k. The rebound highlights the depth of underlying demand, particularly from institutional ETF flows, which continue to provide a backstop. Equities have followed a similar trajectory, with U.S. stocks shaking off the trade-related sell-off to recover into the new week. The combination of resilient earnings, a softer tone in rates markets, and expectations that the Fed remains on course to ease policy in 2025 has helped restore risk appetite. As stocks and crypto have moved broadly in tandem, the recovery suggests last week’s turmoil was more a liquidity event than a fundamental reset. Still, fragilities remain. The trade backdrop continues to inject uncertainty into the global outlook, and the episode has reinforced concerns over the robustness of crypto market infrastructure. While investors appear willing to look through the disruption, confidence could be tested again should external shocks resurface. For now, the takeaway is that both crypto and traditional risk assets have managed to steady themselves quickly after a historic dislocation. The balance of risks into the week remains two-sided: the recovery momentum is encouraging, but the scars of forced deleveraging and the persistence of macro headwinds argue for continued caution. |

| LMAX Digital metrics | ||||

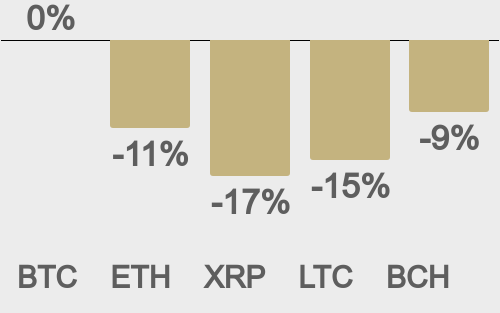

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

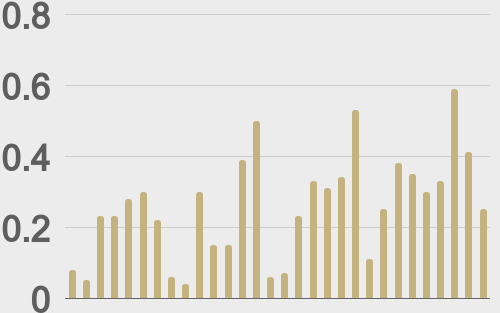

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@yq_acc |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||