|

|

20 January 2022 Crypto still hanging on US equities |

| LMAX Digital performance |

|

LMAX Digital volume picked up nicely on Wednesday. Total notional volume for Wednesday came in at $775 million, 34% above 30-day average volume. Bitcoin volume printed $428 million on Wednesday, 37% above 30-day average volume. Ether volume came in at $260 million, 39% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,417 and average position size for ether at 5,294. Volatility has been trending lower into 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,836 and $189 respectively. |

| Latest industry news |

|

We still feel a lot of what we’re seeing in crypto is about reacting to flows in traditional markets. And so, with US equities under pressure but not yet extending the run of recent declines, we’re in a bit of a wait and see mode, with both bitcoin and ether chopping around, not yet ready to make an fresh commitments. Having said that, there is still a great deal of downside pressure on US equities and there is risk building for another major downside extension. The key level to watch right now is the S&P 500 December low. Should that level get taken out, it will likely open the floodgates, which in turn, should open renewed selling pressure in the crypto space. Of course, as we’ve highlighted many times, we do anticipate a moment when crypto will break away from the risk off correlation, with both bitcoin and ether expected to recover even if stocks continue to fall on the basis of the longer-term value proposition. As far as crypto specific headlines go, there isn’t much. But we have been hearing some things out from the regulatory side. A top EU financial regulator has renewed calls for a bloc-wide ‘ban’ on the main form of bitcoin mining and sounded the alarm over the rising proportion of renewable energy devoted to crypto mining. |

| LMAX Digital metrics | ||||

|

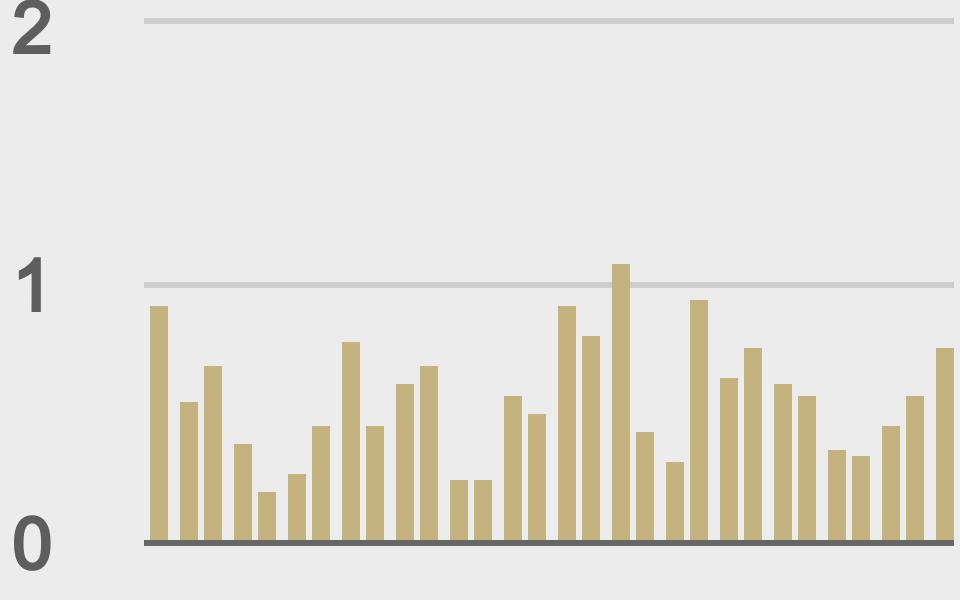

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

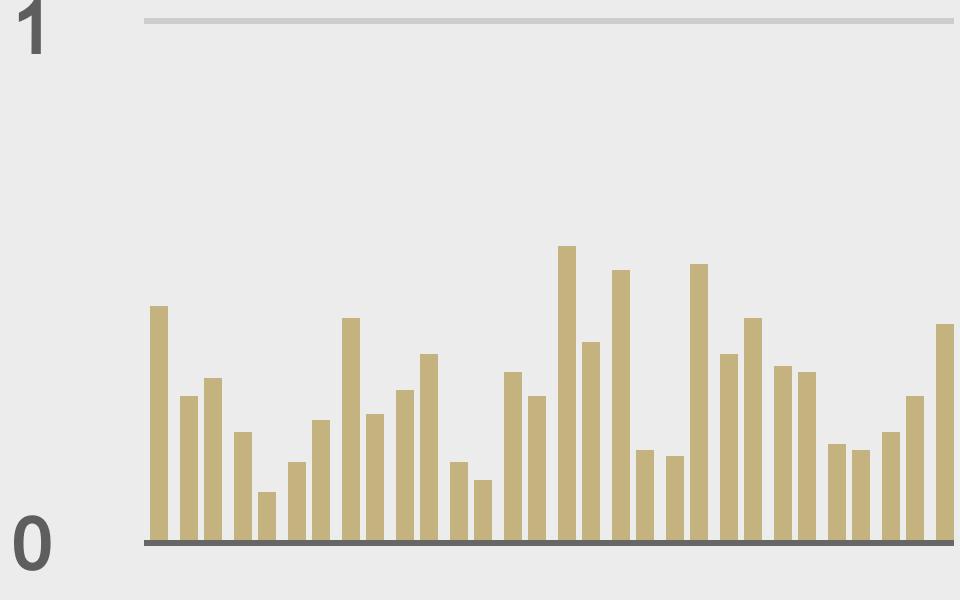

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

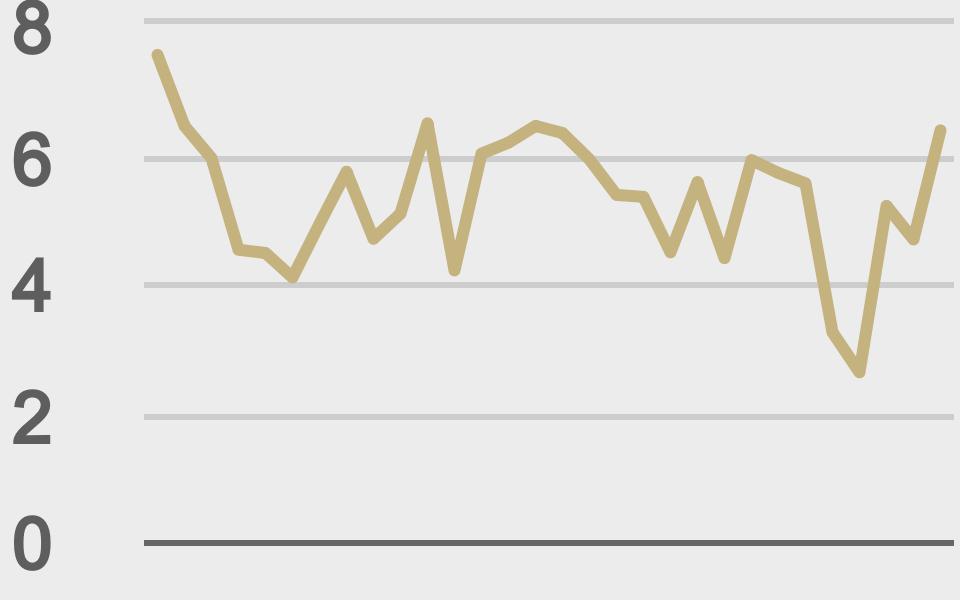

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||