|

|

8 May 2025 Crypto surges as bitcoin eyes $100k |

| LMAX Digital performance |

|

LMAX Digital volumes improved from Tuesday levels. Total notional volume for Wednesday came in at $389 million, on par with 30-day average volume. Bitcoin volume printed $222 million, 8% above 30-day average volume. Ether volume came in at $69 million, 11% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,555 and average position size for ether at $1,635. Volatility is tracking at yearly lows, with bitcoin volatility at its lowest since November 2024 and ETH at its lowest since February 2024. We’re looking at average daily ranges in bitcoin and ether of $2,632 and $84 respectively. |

| Latest industry news |

|

The crypto market has maintained strong momentum this week, with bitcoin eyeing a push above the $100,000 mark. Robust institutional interest, evidenced by daily inflows into BlackRock’s Bitcoin ETF, alongside a major batch of short liquidations, has fueled a lot of this upward drive. The crypto Fear & Greed Index reflects heightened optimism among investors, reinforcing a bullish market sentiment. Traditional markets have also influenced crypto’s performance. Easing geopolitical risks, including renewed U.S.-China trade talks and reduced tensions in global trade dynamics, have further bolstered risk-on sentiment. China’s 1 trillion RMB liquidity injection has also catalyzed gains across equities, commodities, and cryptocurrencies, with bitcoin trading volume picking back up. And the Federal Reserve’s latest decision has been absorbed calmly by markets, supporting the broader risk appetite. Ethereum mainnet’s Pectra upgrade, activated smoothly on Wednesday, has sparked renewed interest in ETH, the second-largest crypto asset. With no reported hitches during the rollout, ETH has capitalized on the upgrade and the broader revival in risk appetite, outperforming other major assets over the past 30 days with a 20% gain compared to bitcoin’s 24%. This marks a significant recovery from ETH’s prior period of underperformance. On the regulatory front, the crypto market is navigating an evolving landscape. In the U.S., President Trump’s pro-crypto stance, including efforts to integrate digital assets into capital markets, continues to support sentiment, though legislative progress remains stalled by tensions surrounding his cryptocurrency ventures. And in the UK, new regulations aligning with U.S. policies signal increasing global coordination, potentially paving the way for greater institutional adoption. |

| LMAX Digital metrics | ||||

|

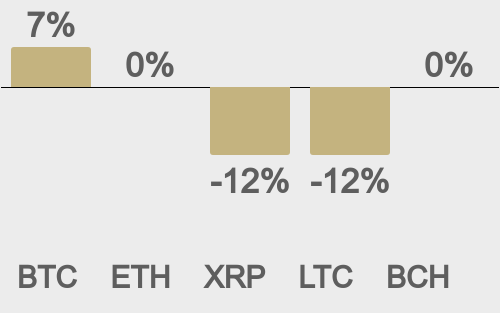

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

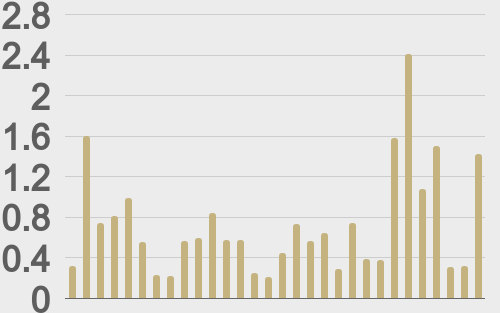

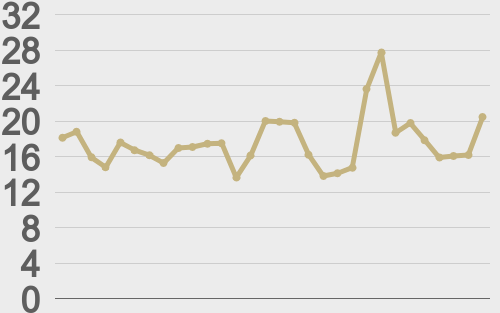

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

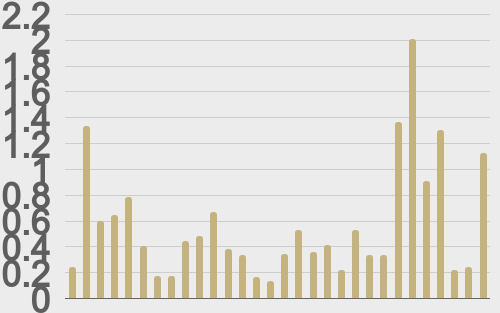

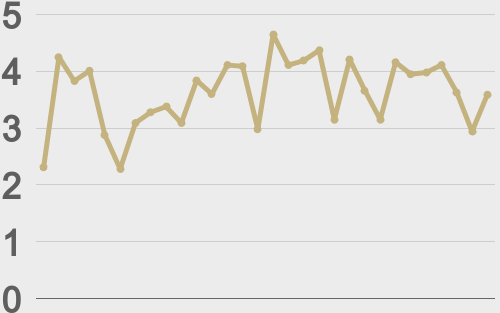

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||