|

|

10 February 2022 Crypto turns to US inflation data |

| LMAX Digital performance |

|

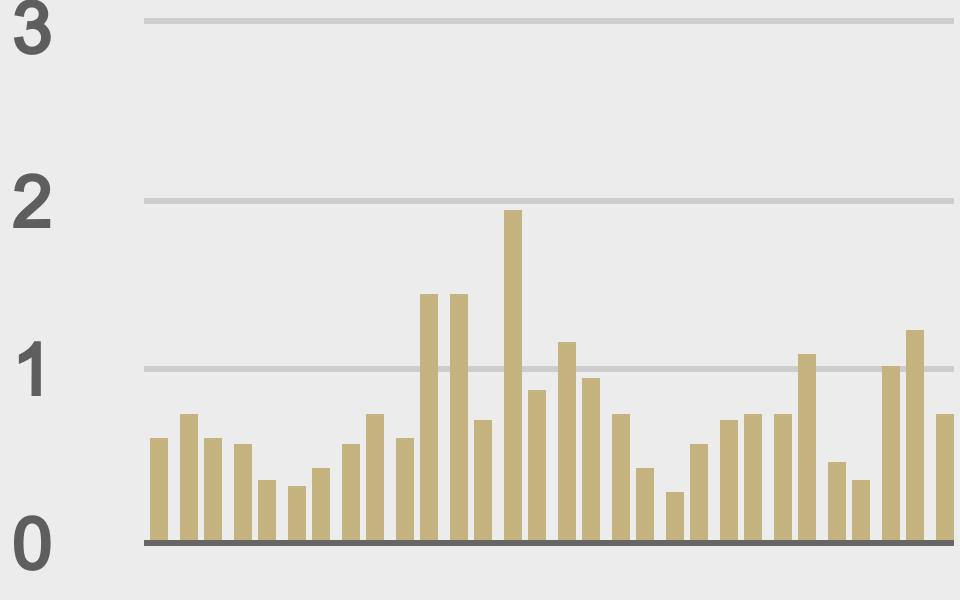

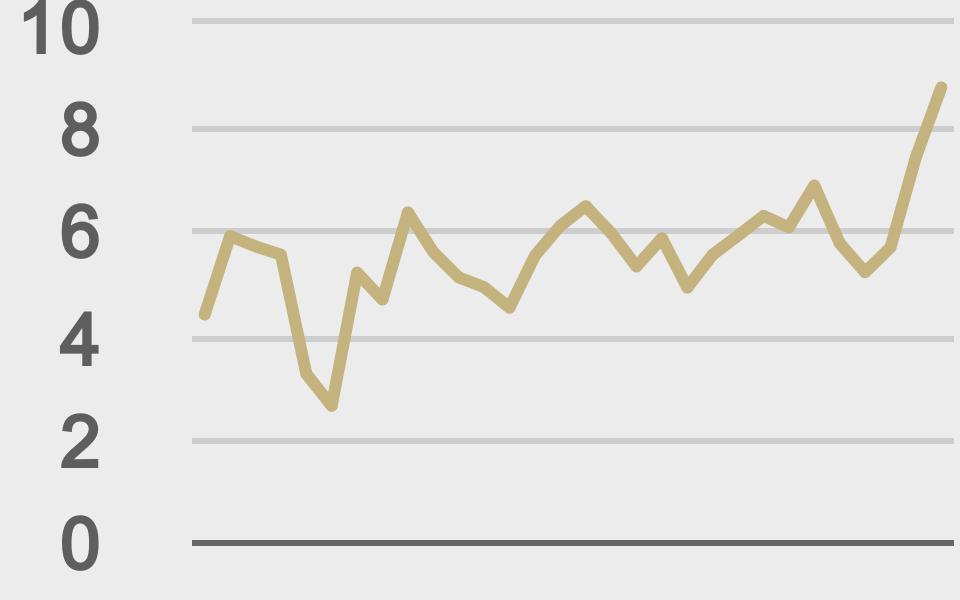

LMAX Digital volume has held steady this week after picking up following the slow Monday start. Total notional volume for Wednesday came in at $784 million, just 2% below 30-day average volume. Bitcoin volume printed $388 million on Wednesday, 8% below 30-day average volume. Ether volume came in at $317 million, 15% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,487 and average position size for ether at 5,567. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,094 and $198 respectively. |

| Latest industry news |

|

We’re staring at what could be an interesting day for bitcoin. A lot of what’s been driving prices in recent months has been global macro fundamentals and overall risk sentiment. Bitcoin has proven to be especially vulnerable during periods of risk off. We’ve highlighted many times the reason for this correlation has everything to do with the fact that to many market participants, bitcoin is still considered to be an emerging market. But as we dig deeper, it’s also clear there is something more to bitcoin than it being classified as a risk correlated asset. In fact, if we look at what bitcoin truly is, we see a decentralized, deflationary, limited supply asset with all the properties of a store of value. The point is that bitcoin has all of the properties that make it a very compelling hedge against inflation. And into 2022, we’re seeing the tremendous challenges to the global system from this threat of rising inflation. So with US CPI on the docket and in the spotlight on this Thursday, it will be interesting to see how bitcoin responds, especially if that inflation data comes in above forecast. We think the market should be thinking about bitcoin more and more as an alternative to gold and we’re already seeing some portfolio managers moving in this direction. But at this stage, we’re not convinced bitcoin has escaped its association as a risk correlated asset and believe there still could be a little more downside from additional capitulation in stocks before we finally do see a price surge on bitcoin’s longer term value proposition. We think this sets up a great opportunity to be looking to build exposure into dips. |

| LMAX Digital metrics | ||||

|

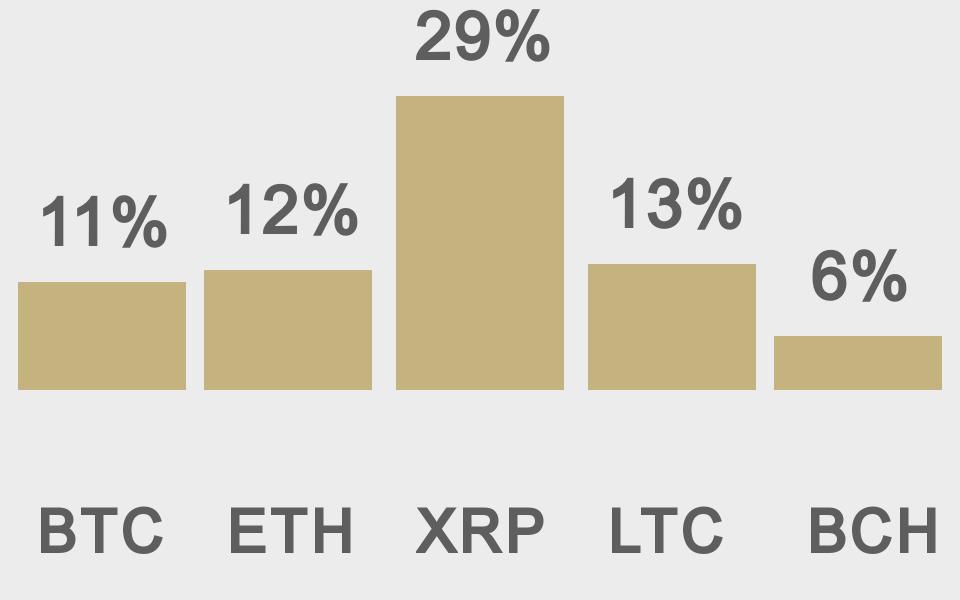

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@woonomic |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||