|

|

4 October 2022 Crypto up on shifting CB policy expectations |

| LMAX Digital performance |

|

LMAX Digital volumes got off positive start this week. Total notional volume for Monday came in at 395 million, 1% above 30-day average volume. Bitcoin volume printed $223 million on Monday, 2% above 30-day average volume. Ether volume came in at $128 million, 7% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,094 and average position size for ether at 2,565. Volatility is still struggling to show signs of picking back up. We’re looking at average daily ranges in bitcoin and ether of $854 and $82 respectively. |

| Latest industry news |

|

Crypto assets have been feeling better this week, largely on account of the tone in broader financial markets. We have been seeing a trend of central banks being less aggressive with rate hikes, and there is a growing expectation this will translate to the same over at the Federal Reserve. But as of now, all of this is speculation more than anything else, and the Fed has shown no signs of intending to ease up with its more aggressive rate hike timeline. The Fed continues to see the greater risk associated with rising inflation, and with that said, Fed policy has been leaning to the more restrictive side. At the same time, we also believe a lot of this won’t really matter as much in the not so distant future, particularly with respect to bitcoin. We say this because, bitcoin has been trading as a risk correlated asset, despite the many properties it has which support the notion that bitcoin should be traded more as a store of value asset. As the bitcoin price has come off in 2022, the case to be buying bitcoin on its longer-term value proposition has become increasingly compelling given the extreme discount in price. So while we wouldn’t rule out deeper setbacks for bitcoin in 2022 from more fallout in financial markets, we also believe bitcoin will be less inclined to be wanting to stay down for any meaningful period of time as investors look to take advantage of the dip. |

| LMAX Digital metrics | ||||

|

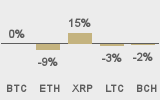

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

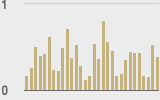

Total volumes last 30 days ($bn) |

||||

|

||||

|

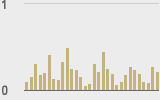

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

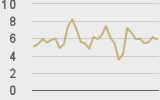

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||