|

| 20 November 2025 Deep pessimism, stronger prospects |

| LMAX Digital performance |

|

LMAX Digital volumes have continued to rise as the week pushes on. Total notional volume for Wednesday came in at $690 million, 10% above 30-day average volume. Bitcoin volume printed $371 million, 7% above 30-day average volume. Ether volume came in at $226 million, 49% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,371 and average position size for ether at $3,115. Bitcoin and ETH volatility remains elevated just off recent multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $4,060 and $223 respectively. |

| Latest industry news |

|

Aggressive pullbacks in crypto may be occurring less frequently as the market matures, but they haven’t disappeared—and investors shouldn’t expect them to. This remains a developing asset class, and sharp drawdowns are still part of its DNA. The difference today is that each cycle brings a reduction in the severity of these moves, reinforcing crypto’s defining characteristic: resilience. Time and again, assets such as Bitcoin and Ether have endured setbacks that would have permanently erased other markets, only to recover from the brink and push on to fresh record highs. Against that backdrop, Bitcoin’s recent retreat looks far more like a reset than a reversal. As we’ve highlighted in recent days, price action has simply drifted back into neutral territory within a broader uptrend. We continue to expect any additional weakness to be well absorbed, paving the way for renewed demand and positioning the market for the next leg higher. Fundamentally, the biggest near-term drag comes from a risk-off tilt and the associated US-dollar strength—both products of a Federal Reserve that has sounded less dovish than markets had hoped, a tone reiterated in the latest FOMC Minutes. Still, history suggests the Fed ultimately gravitates toward market expectations, and we wouldn’t be surprised to see communication—and eventually policy—shift in that direction over the weeks ahead. On the supportive side, crypto is catching some spillover optimism following Nvidia’s stronger-than-expected earnings, which reinforced confidence in the broader growth-and-innovation complex. When investors feel validated about where the world is heading, that enthusiasm often extends to crypto. More importantly, sentiment across the digital asset space has collapsed to extremely low levels—conditions that, historically, have been powerful contrarian buy signals. Periods of deep pessimism have often preceded meaningful bullish reversals. We may be approaching another one. Let’s see if this proves to be the case. |

| LMAX Digital metrics | ||||

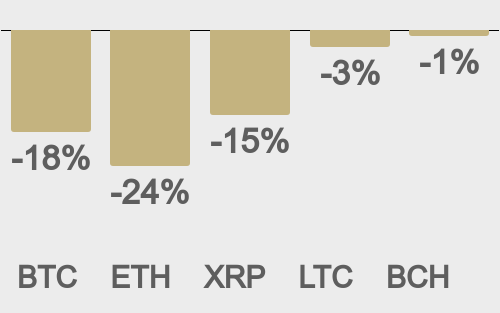

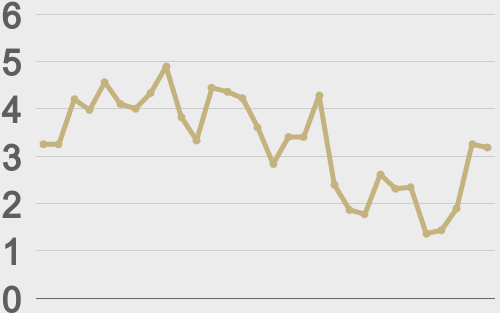

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

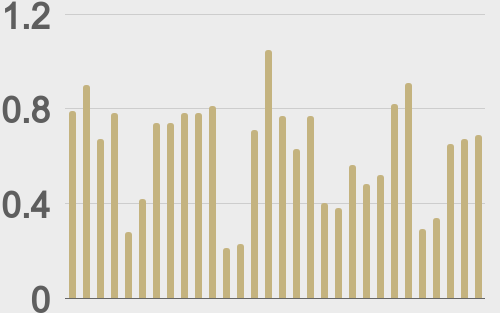

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

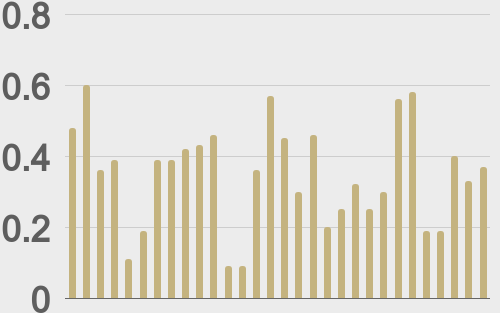

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||