|

|

23 September 2024 Demand for crypto beyond bitcoin |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $2.1 billion, 34% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.4 billion, 46% higher than the previous week. Ether volume came in at $428 million, 16% higher than the week earlier. Total notional volume over the past 30 days comes in at $8.5 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,933 and average position size for ether at $2,521. Market volatility could finally be showing signs of wanting to bottom out after cooling off rapidly since August. We’re looking at average daily ranges in bitcoin and ether of $2,208 and $121 respectively. |

| Latest industry news |

|

Appetite for crypto assets has picked up quite a bit in recent sessions. The primary catalyst has unquestionably come from last Wednesday’s Fed decision in which the central bank opted to cut rates by 50 basis points. The move has inspired demand for crypto because yield differentials are moving out of the US Dollar’s favor, inflation pressures are likely to turn back up after such an aggressive move, and investors are happy to be looking at risk correlated investments after the market friendly Fed gesture. The health of the demand for crypto can perhaps best be reflected in a run of outperformance in the price of ETH relative to bitcoin since the Fed decision. ETH has been hit hard against bitcoin over the past several months and signs of life here are a positive for the crypto space overall. The reversal in this ratio suggests demand for crypto assets beyond bitcoin, which is supportive of the growth of crypto assets across the board. Technically speaking, bitcoin remains confined to a major consolidation and is waiting for signs of a bullish continuation to fresh record highs. With that said, there is some initial resistance at $65,000, which if overcome, would strengthen the prospect for the start to a bullish continuation. |

| LMAX Digital metrics | ||||

|

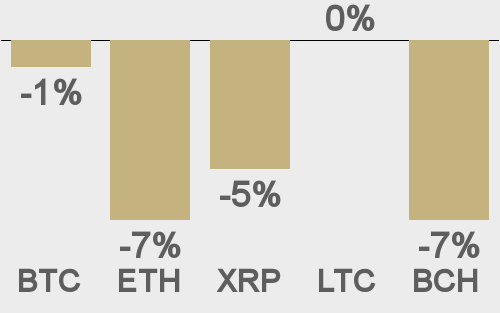

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

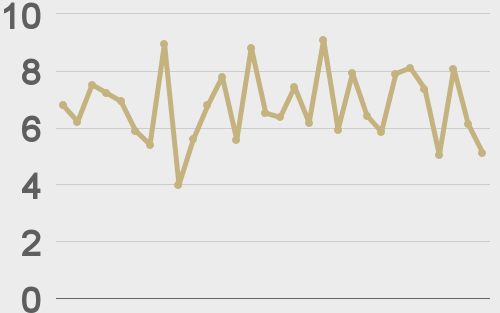

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||