|

|

18 December 2024 Dips continue to be well supported |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off on Tuesday. Total notional volume for Tuesday came in at $684 million, 29% below 30-day average volume. Bitcoin volume printed $267 million on Tuesday, 51% below 30-day average volume. Ether volume came in at $115 million, 9% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $13,033 and average position size for ether at $2,724. Bitcoin volatility is just off its highest levels of the year, while ETH volatility is just off its highest levels since April. We’re looking at average daily ranges in bitcoin and ether of $3,890 and $191 respectively. |

| Latest industry news |

|

The crypto market has been more cautious of late, with many participants worrying about the possibility for a healthy correction after the bitcoin run extended up towards $110k on Tuesday. Technically speaking, on a medium to longer-term basis, the previous breakout zone around $75k should now act as formidable support for bitcoin. But at the moment, dips have been exceptionally well supported and there could be more room for gains to extend through $120k before the year is out. Seasonal trends and optimism around the incoming US administration continue to fuel plenty of demand, with many more traditional market participants making plans to take on exposure in 2025. We also see room for the price of ETH to start making a run towards a retest of its record high from 2021, something that could help to keep bitcoin dips well supported in the days and weeks ahead. There is good reason to believe investor interest will spread to the wonders of smart contracts and innovation around defi products on Ethereum. Look for a weekly close in ETH above $4k to do a good job in accelerating the rally towards a retest of the record high from 2021, which could easily play out between now and year end. As far as today goes, it will be important to keep an eye on the Fed decision. The Fed is expected to cut rates by 25 basis points. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

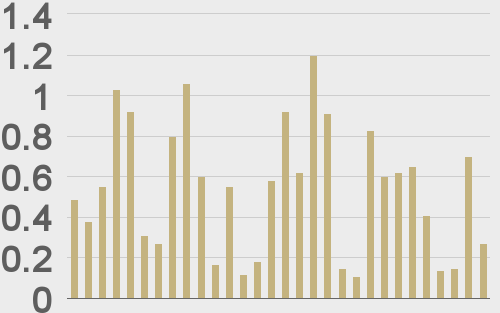

Total volumes last 30 days ($bn) |

||||

|

||||

|

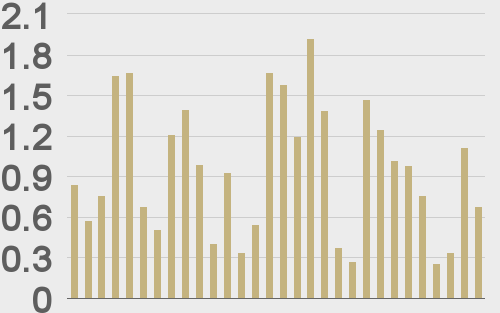

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

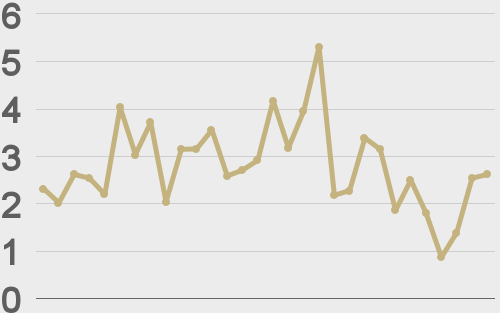

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

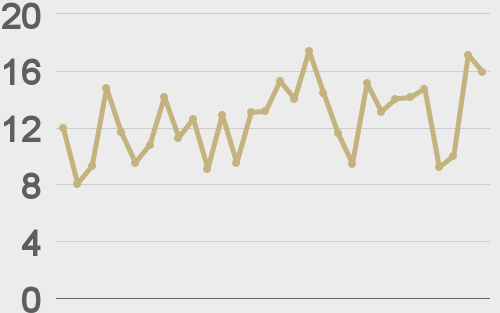

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||