|

|

13 May 2025 Dips should be well supported |

| LMAX Digital performance |

|

LMAX Digital volumes were impressive as the week got going. Total notional volume for Monday came in at $918 million, 133% above 30-day average volume. Bitcoin volume printed $442 million, 122% above 30-day average volume. Ether volume came in at $149 million, 73% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,090 and average position size for ether at $1,853. Volatility has been tracking higher after bottoming out at yearly lows. We’re looking at average daily ranges in bitcoin and ether of $2,815 and $137 respectively. |

| Latest industry news |

|

Over the past week, the cryptocurrency market has delivered a striking performance, with Bitcoin surging past $100,000 and Ethereum staging a remarkable recovery, outpacing expectations. Currently, the market appears to be pausing for breath, yet the prevailing sentiment in recent headlines suggests this rally still has room to grow. A resurgence in appetite for crypto assets has captured widespread attention, fueled by easing global macroeconomic concerns. However, several other dynamics merit consideration. One notable factor is the increasing mainstream adoption of cryptocurrency, as evidenced by developments in U.S. financial markets. Coinbase’s inclusion in the S&P 500 marks a historic milestone, establishing it as the first crypto-native company to join this prestigious index. Additionally, optimism surrounds the anticipated implementation of crypto-friendly regulations in the United States. SEC Chair Atkins has pledged to position the U.S. as the global hub for cryptocurrency innovation, fostering a supportive regulatory environment. The market has also been buoyed by renewed demand for Ethereum, the world’s second-largest crypto asset. This resurgence signals robust investor enthusiasm for digital assets beyond Bitcoin. Ethereum’s latest upgrade, designed to enhance scalability, user experience, and staking efficiency, further strengthens its appeal. Looking to today, volatility may arise with the release of the latest U.S. CPI data. Investors are hoping for a subdued inflation reading, which could encourage the Federal Reserve to adopt a more accommodative monetary stance. Should the data fall below expectations, it could spur demand for equities, with positive spillover effects into crypto markets. Conversely, even if inflation data exceeds forecasts, crypto assets may remain resilient. Recent price action demonstrates their ability to outperform during periods of profit-taking in U.S. equities, underscoring Bitcoin’s growing allure as an uncorrelated asset with distinct investment appeal. |

| LMAX Digital metrics | ||||

|

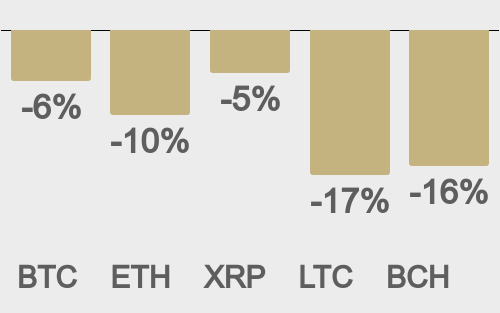

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

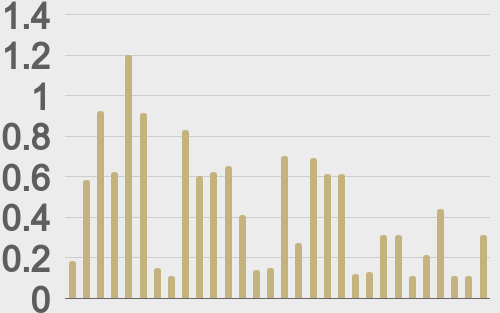

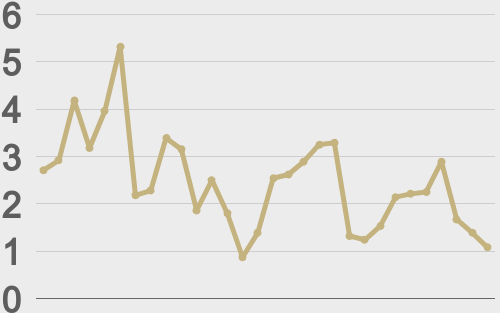

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

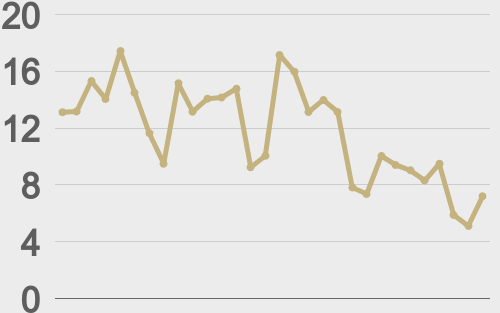

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||