|

|

5 November 2022 Downbeat news falls on deaf ears |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital took a dip in the previous week as volatility cooled off. Total notional volume from last Monday through Friday came in at $2.1 billion, 42% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.1 billion in the previous week, down 47% from a week earlier. Ether volume came in at $781 million, 45% lower than the week earlier. Total notional volume over the past 30 days comes in at $10.3 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,659 and average position size for ether at $2,835. Volatility is showing some signs of life after trading to yearly and multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $625 and $78 respectively. |

| Latest industry news |

|

We saw a surge in demand for risk assets this past Friday, which helped to fuel a fresh wave of buying interest in cryptocurrencies. The catalyst for a good portion of the price action was attributed to speculation around a reopening in China. But overall, the move felt a little exaggerated given there was no confirmation out of China, and given the fact that the US jobs report continued to paint a picture in which the Fed would be needing to stick to more hawkish, less investor friendly monetary policy. Fundamentally, a downbeat report out of JP Morgan highlighting a slumping crypto venture capital space, and warnings from a major crypto exchange about the potential for the crypto rout to persist or even intensify, have mostly fallen on deaf ears, with crypto performing well despite these darker developments. Technically, we’ve highlighted the potential for a major base taking form in bitcoin, by way of a double bottom formation. We use bitcoin as the proxy for direction in the broader crypto market. If we see bitcoin break back above the neckline of this double bottom formation, which comes in around $25,200, it would likely alter broader sentiment in the space and invite a bigger surge in demand for crypto assets. Until then, the outlook remains bearish. |

| LMAX Digital metrics | ||||

|

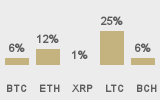

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||