|

| Druckenmiller talks crypto and USD status |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off on Tuesday with total notional volume coming in at $1.88 billion, 12% below 30-day average volume of $2.13 billion. However, while we did see a dip below the 30-day average volume in Bitcoin, Ether volume was still holding above 30-day average volume of $492 million at $537 million for the day. Average BTCUSD trade size at LMAX Digital held around the monthly range low of $12,000, very much consistent with the consolidative price action in Bitcoin. Average ETHUSD trade size retreated from above $10,000 back down below $8,000. Ether has continued to extend its record run against the US Dollar, with the price increase perhaps contributing to the reduction in average position size. |

| Latest industry news |

|

The insatiable appetite for Ether has only intensified in recent days, with the crypto asset continuing to extend its record run. What makes the move all the more impressive is the fact that we have been seeing this demand continue despite very clear downside pressure in US equities. While we wouldn’t read too much into this shorter term observation, it is interesting nonetheless and could reflect a rotation into an emerging crypto asset class still seen as tremendously undervalued despite risk off flow. Well known investor Stanley Druckenmiller was on the wires on Tuesday helping crypto assets along after talking down the outlook for the US Dollar as the world’s reserve currency, suggesting crypto would be the most likely candidate to replace the Buck. Meanwhile, Newsweek was out with the results of a poll that showed 46 million Americans now owning Bitcoin. As far as price action goes, we do believe Ether bulls should be proceeding with extreme caution. We see any continued downside pressure on stocks likely to inspire profit taking in an Eth market that is highly overextended as per our technical insights in today’s report. And while crypto assets aren’t usually all that sensitive to economic data, we would be looking out for today’s US inflation data to play a part, particularly if it comes in above forecast. We also suspect market dynamics could soon warrant outperformance in Bitcoin relative to Ether. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

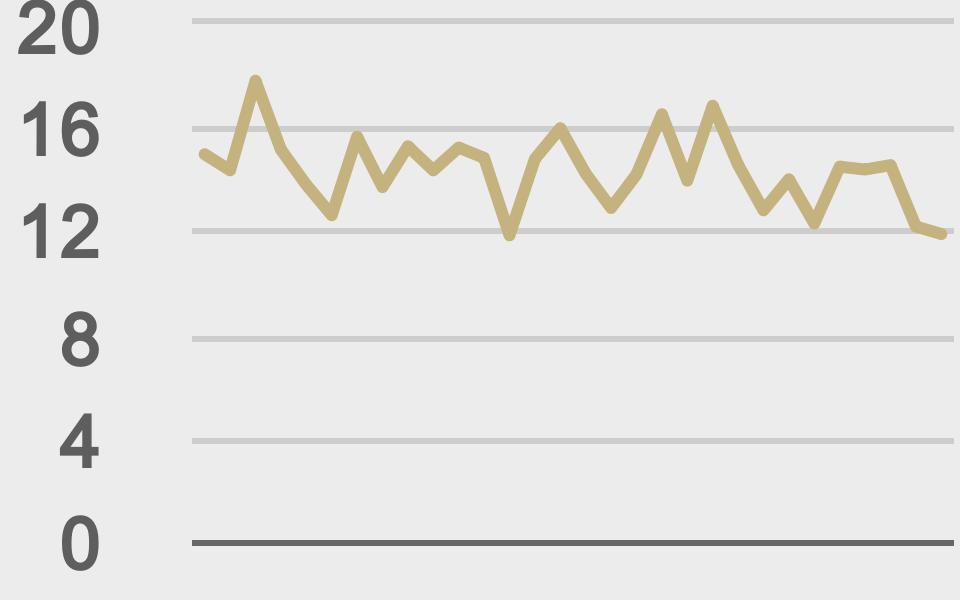

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

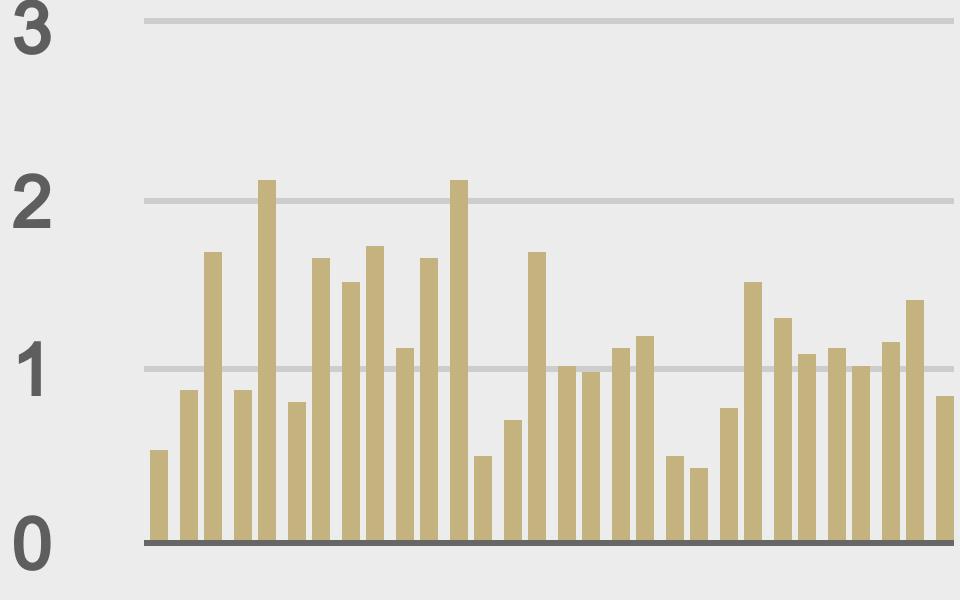

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

|

||||

|

@nlw |

||||

|

@mrjasonchoi |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||