|

|

24 March 2025 Encouraging price action signs |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $2.1 billion, 19% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.1 billion, 7% lower than the previous week. Ether volume came in at $328 million, 49% lower than the week earlier. Total notional volume over the past 30 days comes in at $14 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,374 and average position size for ether at $1,914. Bitcoin volatility has fallen back into a familiar consolidation range. ETH volatility has been trending lower towards multi-week lows. We’re looking at average daily ranges in bitcoin and ether of $3,644 and $130 respectively. |

| Latest industry news |

|

The crypto market is still trying to establish renewed bullish momentum after struggling for much of Q1 2025. But we are finally seeing some positive signs within the price action that suggest we could be getting closer. As far as bitcoin goes, we’ve highlighted the need for bitcoin to get back above the March high just over $95k to send a stronger bullish message. But on a short-term basis, a break back above $87,500 would be encouraging. ETH price action has also been welcome of late. Last week, ETH finally managed to reclaim $2k after consolidating below the level for many sessions. And this week already, ETH has extended the recovery run to multi-session highs. Yet another bullish price action update comes from the relationship between ETH and bitcoin. ETH has been severely underperforming against bitcoin since 2022 and is desperate to put in a bottom of some kind. ETH has been showing signs of outperformance since bottoming on March 13th and the outperformance against bitcoin suggests appetite for crypto assets overall is picking back up, with investors looking to take on exposure beyond bitcoin. Fundamentally speaking, we believe the return of inflows into the bitcoin ETFs, more dovish leaning Fed decision, and diffusion in tension associated with worry around the severity of US tariffs have all been helping to inspire the across the board renewed bid in crypto assets. |

| LMAX Digital metrics | ||||

|

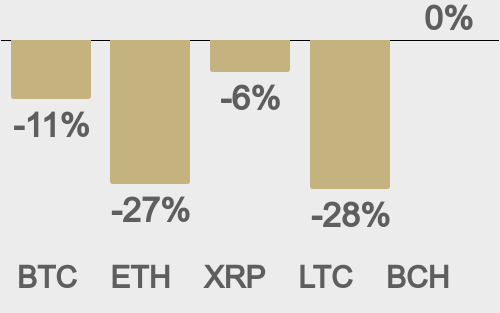

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

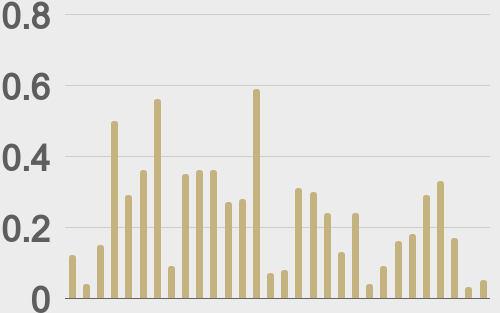

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

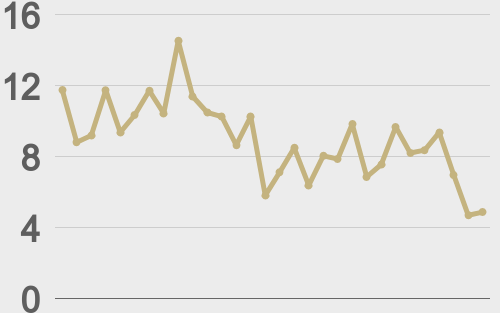

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||