|

|

10 February 2025 Endowments coming to crypto |

| LMAX Digital performance |

|

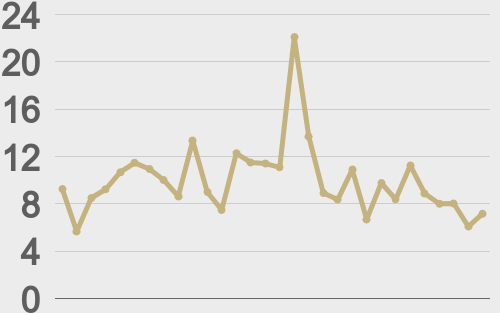

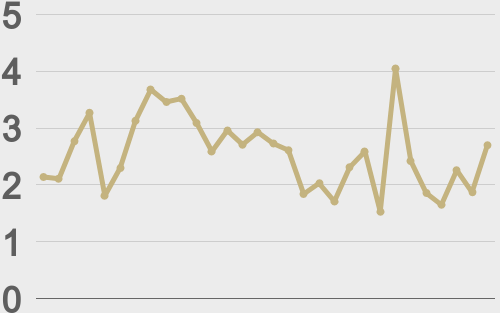

Total notional volume from last Monday through Friday came in at $4.2 billion, 16% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.8 billion, 24% lower than the previous week. Ether volume came in at $1 billion, 160% higher than the week earlier. Total notional volume over the past 30 days comes in at $19.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,601 and average position size for ether at $2,562. Market volatility is consolidating just off peak levels. We’re looking at average daily ranges in bitcoin and ether of $4,072 and $214 respectively. |

| Latest industry news |

|

Market activity has been relatively stable in recent sessions and crypto assets have managed to successfully avoid the intense bearish price action that was seen last weekend. We do think it’s worth highlighting just how compelling crypto is as an asset class given that it allows market participants to access deep liquidity on a Saturday or Sunday – something traditional assets do not offer. Crypto as a 24/7 asset class is something that we believe is underappreciated and not emphasized enough in terms of just how much of a difference maker this is for global markets overall. As far as recent developments go, risk markets took a bit of a hit on the news of President Trump’s new 25% tariff on steel and aluminum. This opened a minor wave of downside pressure on crypto assets before the dip was absorbed by medium and longer-term accounts looking to take advantage. But perhaps the most noteworthy story comes out of the Financial Times, with the publication highlighting an uptick in demand for crypto assets from endowments and foundations that had been on the sidelines. This supports the narrative of broader institutional adoption and a maturity in crypto as an asset class, which should only invite additional demand in the weeks and months ahead. |

| LMAX Digital metrics | ||||

|

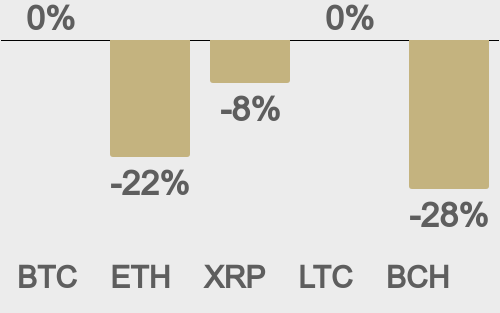

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

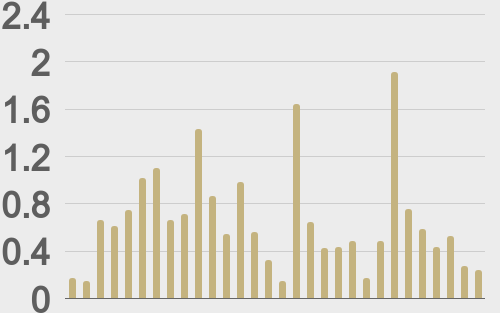

Total volumes last 30 days ($bn) |

||||

|

||||

|

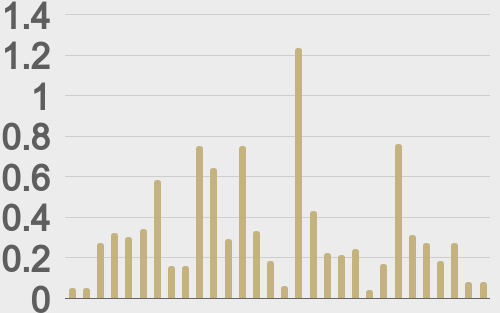

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||