|

|

25 October 2023 Enthusiasm for crypto continues to run hot |

| LMAX Digital performance |

|

LMAX Digital volumes traded at their highest levels since Q1 2023 on Tuesday, crossing above the yard mark. Total notional volume for Tuesday came in just over $1 billion, 280% above 30-day average volume. Bitcoin volume printed $696 million on Tuesday, 299% above 30-day average volume. Ether volume came in at $222 million, 225% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,044 and average position size for ether at $2,627. Volatility has broken out to the topside this week. Bitcoin volatility has traded to its highest level since April, while ether volatility is at its highest level since July. We’re looking at average daily ranges in bitcoin and ether of $1,158 and $56 respectively. |

| Latest industry news |

|

Market enthusiasm around crypto has been running high over the past several sessions. Most of this enthusiasm has been directed towards bitcoin, as evidenced by the strong uptrend in bitcoin dominance, which sits comfortably back above 50%. Still, we have seen the positive sentiment towards bitcoin spill over into other crypto assets. Indeed, most of the next wave of institutional flow into crypto is expected to run through bitcoin. But this also sets the stage for demand for other crypto assets as well. The more strained global outlook has also factored into bitcoin outperformance relative to other crypto assets. Geopolitical tension and ongoing monetary policy divergence between the Fed and other major central banks has resulted in risk off flow. Bitcoin is the safe haven asset when it comes to crypto, which means a natural flight to safety into bitcoin and relative outperformance in risk off. We’re also seeing many market participants waking up to the reality of bitcoin as a safe haven asset in traditional markets. Look no further than the latest run up in bitcoin along with gold, despite downside pressure in stocks. Of course, there are other stories driving bitcoin outperformance of late. Those revolve around optimism the SEC will approve a bitcoin spot ETF at some point between now and Q1 2024. On Tuesday, the BlackRock ETF showed up on the website of Depository Trust & Clearing Corp. – a key market utility in the US that processes all securities transactions. One final narrative that could be driving bitcoin demand is a recent report that shows options dealers needing to purchase almost $20 million of bitcoin for every 1% move higher in the price, in order to stay delta neutral. |

| LMAX Digital metrics | ||||

|

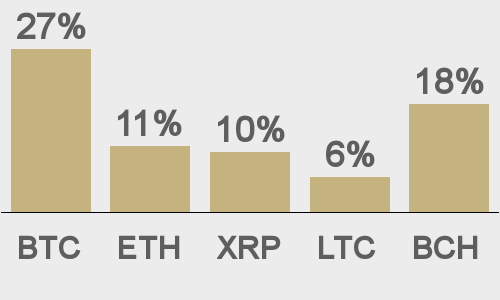

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

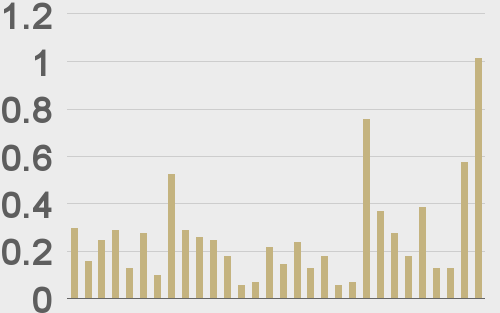

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

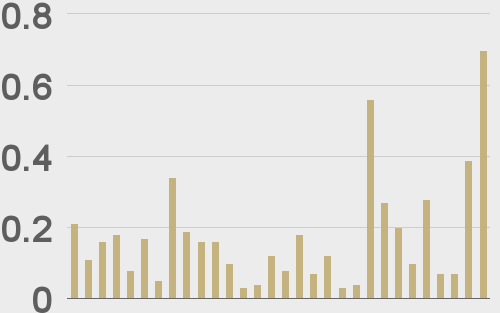

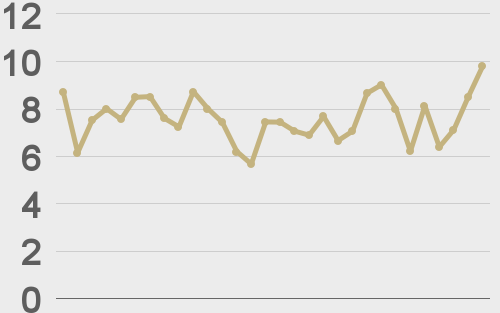

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

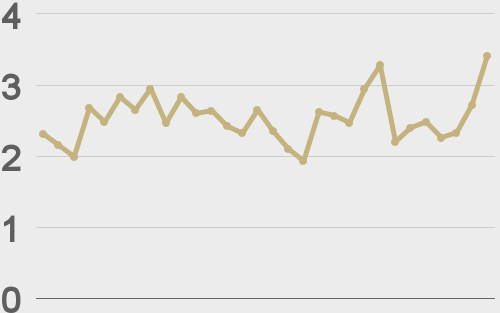

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||