|

| 28 July 2025 ETH hits stride as ETF flows surge |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $4.3 billion, 14% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.96 billion, 12% lower than the previous week. Ether volume came in at $1 billion, 20% lower than the week earlier. Total notional volume over the past 30 days comes in at $17 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,913 and average position size for ether at $2,905. Bitcoin volatility continues to track just off yearly low levels. ETH volatility has picked up and has recently pushed to its highest levels since March. We’re looking at average daily ranges in bitcoin and ether of $2,710 and $161 respectively. |

| Latest industry news |

|

Bitcoin remains confined to consolidation but continues to find plenty of demand. Japan’s Metaplanet added another 780 BTC (~$93 million), bringing its corporate holdings to 17,132 bitcoin, valued at roughly $2 billion — reinforcing Asia’s rising influence in institutional bitcoin treasury strategies. These high-profile purchases have helped to keep prices well supported, though broader macro signals—such as uncertainty over U.S. fiscal policy and softening equity momentum—have somewhat offset and kept the market contained. ETH however continues to outperform, extending its run of fresh yearly highs and inching closer to the $4,000 psychological barrier. Demand dynamics remain incredibly strong. U.S. spot ETH ETFs pulled in $1.85 billion during the week of July 21–25—the second largest week on record—and total ETF inflows have now exceeded $7.8 billion, already surpassing all of 2024’s ETH ETF inflows. Meanwhile, SharpLink Gaming has been out buying more ETH, this time $295 million worth of ETH, pushing total holdings in excess of 438,000 ETH (~$1.7 billion). ETF and treasury-level inflows continue to shape ETH’s narrative. Ethereum futures open interest on CME topped a record $7.85 billion, highlighting growing usage by institutions balancing risk with targeted exposure. The combined weight of these flows underscores a “demand shock” environment – ETF and corporate buying comfortably outpacing supply, supporting a steep reduction in sell-side pressure. Ultimately, bitcoin has already enjoyed an exceptional run over the past several months and is now in a healthy period of consolidation. ETH on the other hand is finally benefiting from the more favorable regulatory backdrop and expectation this will translate to a greater interest in decentralized finance and the tokenization of real-world assets. From a macro and political standpoint, things are relatively steady. The market is getting set to take in this week’s corporate earnings, FOMC updates, Q2 GDP, Core PCE inflation, and non-farm payrolls data while also digesting news around trade deals. Political debates over stablecoin oversight and banking data access will need to be monitored. Rising geopolitical tensions, particularly in Asia and Europe, will also keep institutional risk appetite calibrated. |

| LMAX Digital metrics | ||||

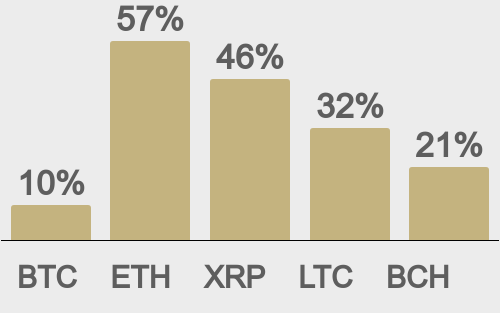

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

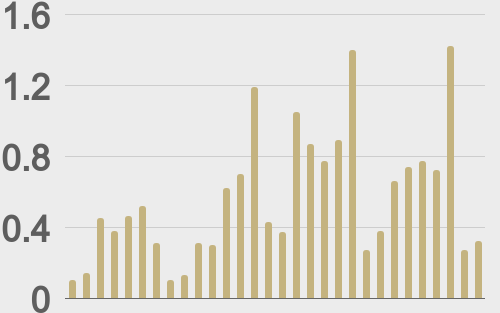

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

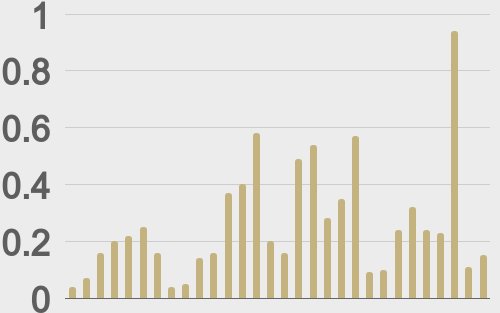

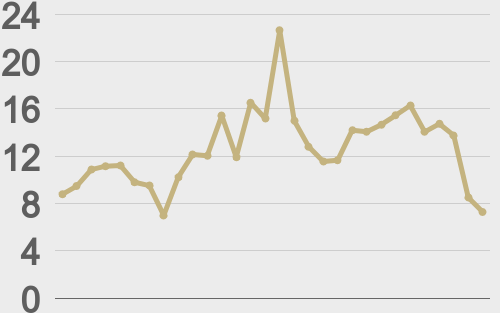

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||