|

|

1 June 2023 Eth holds up better than bitcoin in May |

| LMAX Digital performance |

|

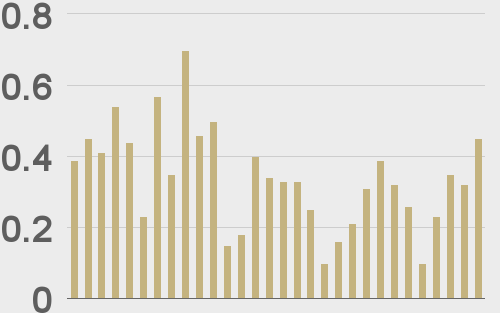

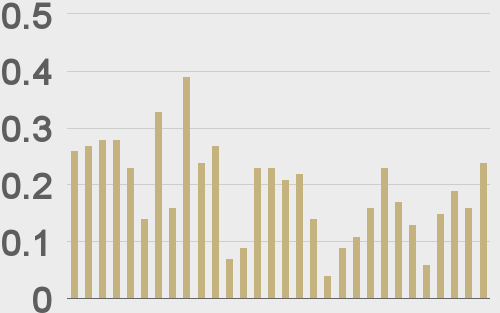

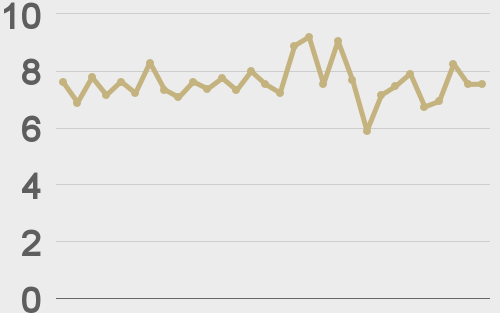

LMAX Digital volumes picked up nicely on Wednesday. Total notional volume for Wednesday came in at $446 million, 31% above 30-day average volume. Bitcoin volume printed $244 million on Wednesday, 26% above 30-day average volume. Ether volume printed $109 million, 14% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,510 and average position size for ether at 2,832. Volatility has been in major correction mode after peaking out at a yearly high in March. We’re looking at average daily ranges in bitcoin and ether of $844 and $57 respectively. |

| Latest industry news |

|

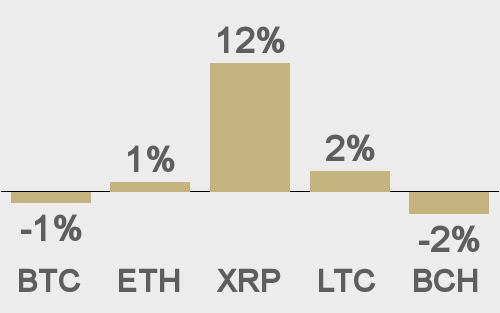

A run of consecutive monthly gains in 2023 came to an end in May, with bitcoin unable to extend to a fresh yearly high, instead, reversing course and opting to close out down on the month. Still, the setbacks were relatively mild, with bitcoin only down 6.9% as compared to the +65% YTD gains. Ether by comparison, wasn’t quite ready to buck the trend, just barely managing a monthly close fractionally higher than the April close. However, just like bitcoin, ether was unable to make a fresh yearly high in May. Fundamentally, there weren’t too many market moving updates within the crypto space in May. Instead, participants were mostly distracted by all of the drama around the US debt ceiling, which quite fittingly came to a resolution as the month closed out. But broad-based US Dollar demand on the back of rising US rates and more hawkish leaning Fed policy did play a part, with crypto prices weighed down as a consequence. At the same time, we continue to see bitcoin well supported on dips in the face of a traditional financial system that continues to print money. Liquidity conditions have indeed thinned out in recent months. But this is more a function of a market that has been confined to tight trading ranges than from a lack of interest in the asset class. Institutional players have been on the sidelines but continue to show plenty of commitment towards building exposure. As far as May’s ether outperformance relative to bitcoin goes, we believe there are two primary drivers here. The first is the more sensible correlation between ether and equities. Stocks were pushing new yearly highs in May, and the more risk correlated ether benefited from this flow. The second driver is the more active ether space amongst the broader crypto market. While there is quite a bit of institutional flow around bitcoin, the broader market continues to be active within the Ethereum ecosystem. Looking ahead, we expect more turbulence from the regulatory front, but more demand to offset as traditional market participants wake up to crypto’s value proposition. We also expect Fed policy communications to play a part, with crypto assets still showing sensitivity to movement in yields and global risk appetite. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

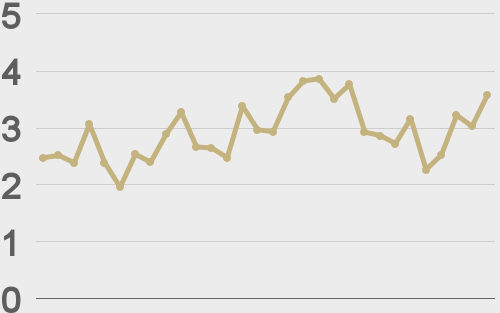

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@mikejcasey |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||