|

|

| Closing in on JP Morgan |

| LMAX Digital performance |

|

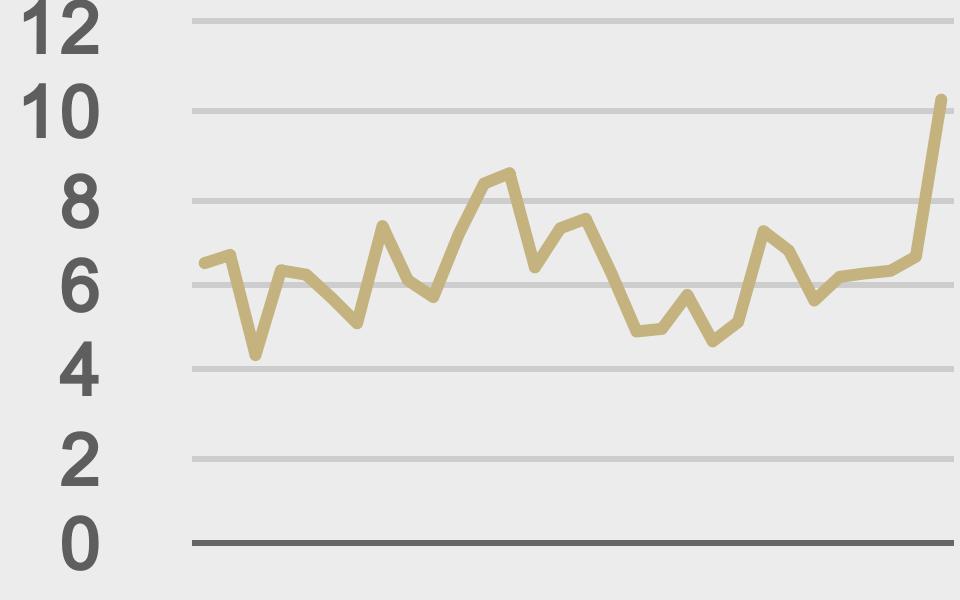

LMAX Digital volumes were up big on Monday. Total notional volume came in at $3.21 billion, 54% above 30-day average volume, and at the highest level since April 23. Bitcoin volume was impressive at $1.44 billion, 23% above 30-day average bitcoin volume. But it was Ether volume that stole the show, at $964 billion, up a dramatic 100% from 30-day average volume. Average BTCUSD trade size at LMAX Digital dropped down into the $12,000 area on Monday, but is still holding within the monthly range, mostly between $12,000 and $16,000. Average ETHUSD trade size continues to impress, trending higher and jumping up to its highest levels, now above $10,000. Ether is getting all of the attention right now, as institutional players increase exposure beyond bitcoin, resulting in fresh record highs for ETHUSD. |

| Latest industry news |

|

We’re seeing some profit taking in crypto markets into Tuesday after the price of Ether had extended its run to yet another record high on Monday, trading up just over $4,200 against the US Dollar. Technical extension and a shakeup in US equity markets were attributed to the latest pullback. Ether is now on the verge of surpassing the market capitalization of JP Morgan, the largest bank in the US. Institutional adoption of cryptocurrencies continues to be a big story in 2021 and this has also resulted in major banks jumping on board. UBS is the latest name that could be stepping into the ring after reports surfaced Switzerland’s largest investment bank was planning to offer wealthy clients exposure to cryptocurrencies. It will be important to pay attention to investor sentiment over the coming sessions, as any further deterioration could have a weighing impact on crypto markets. A lot of the run into crypto in 2021 has been about exceptionally favourable traditional market conditions on incentives from central banks and governments to invest in risk correlated assets. If we do see an intensification of risk off flow, look for the more risk correlated ether to underperform relative to Bitcoin. |

|

LMAX Digital metrics |

||||

|

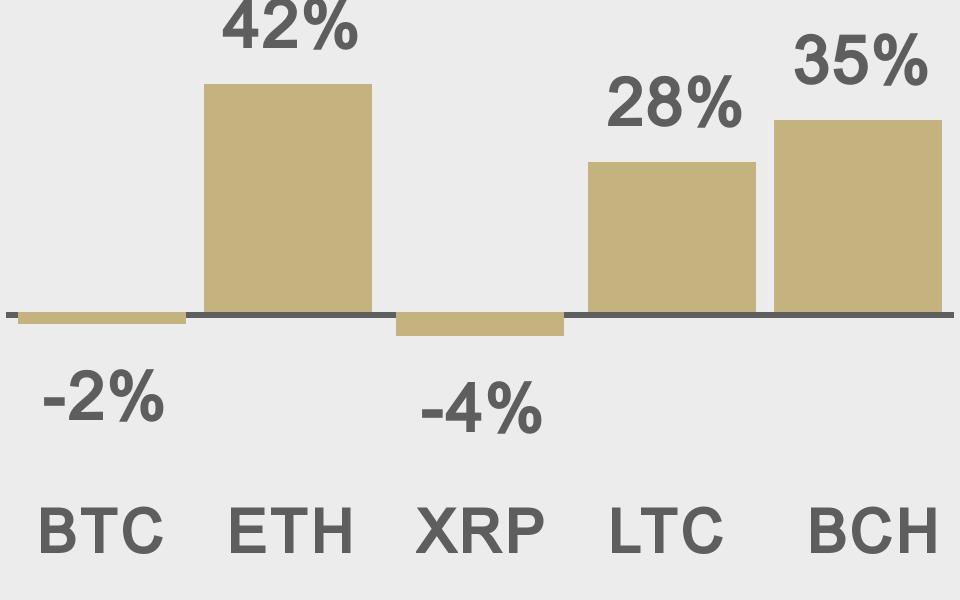

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

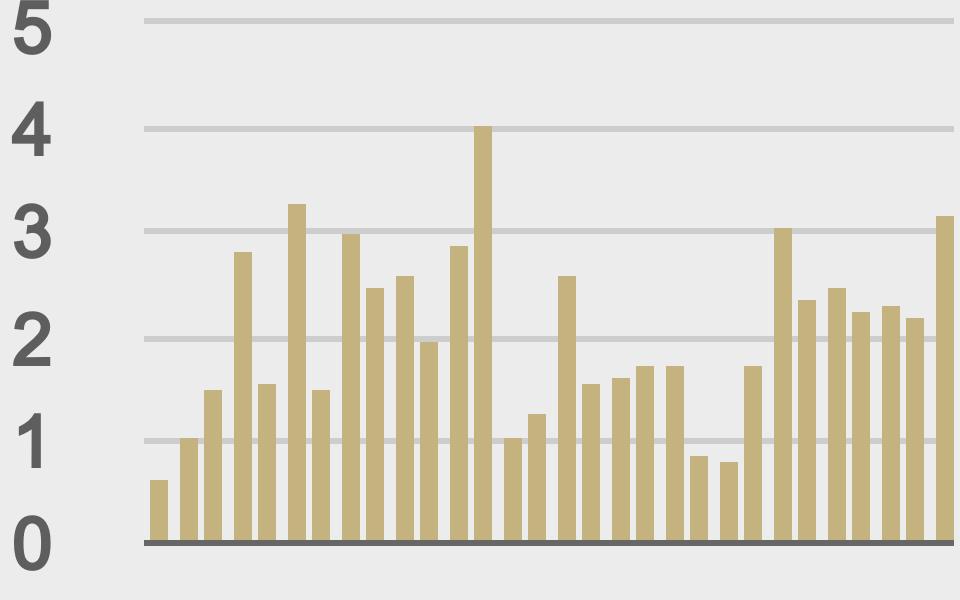

Total volumes last 30 days ($bn) |

||||

|

||||

|

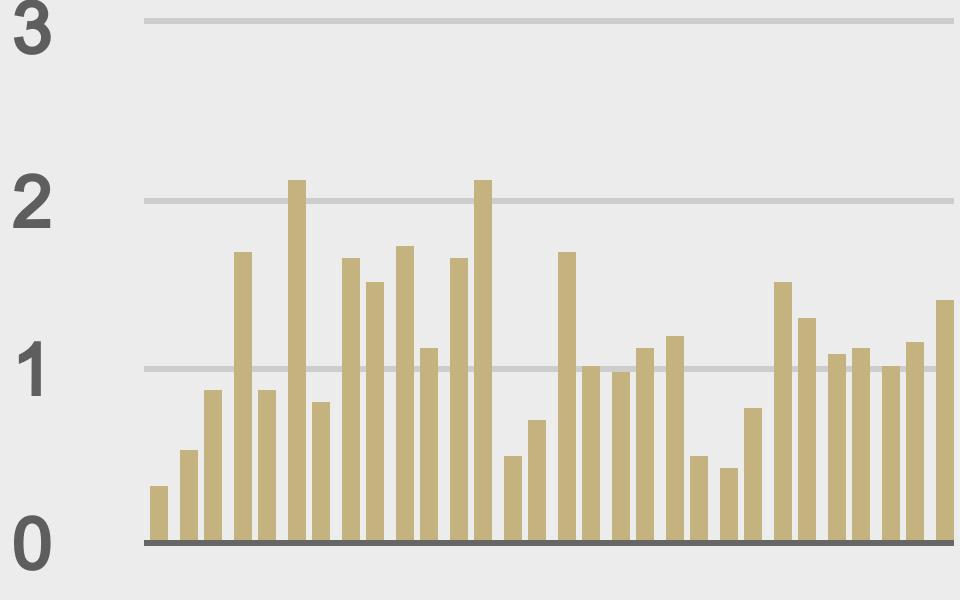

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

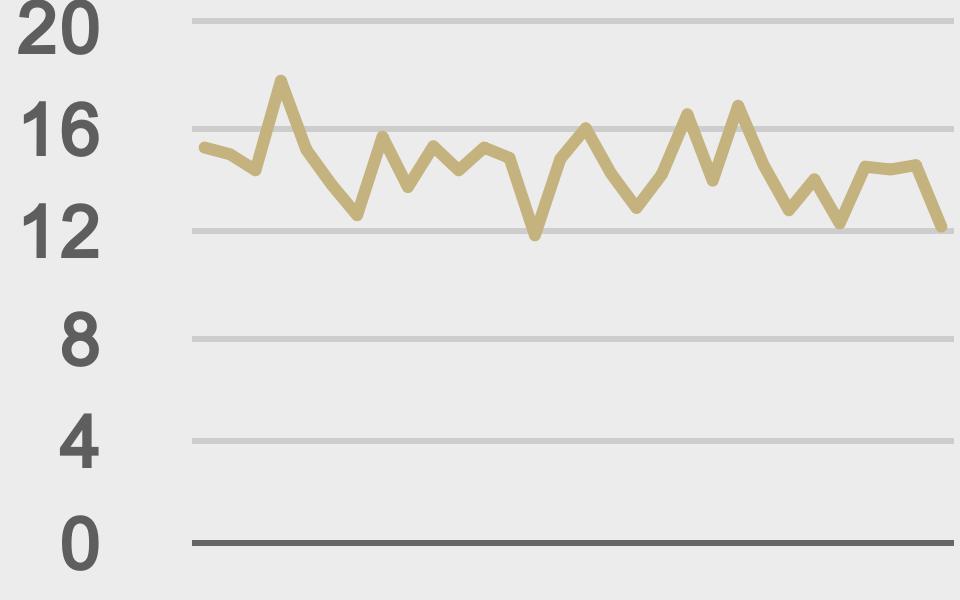

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

|

||||

|

@RemiGMI |

||||

|

@Eug_Ng |

||||