|

|

28 October 2021 Ether outpaces bitcoin |

| LMAX Digital performance |

|

LMAX Digital volumes came roaring back on Wednesday after a lull in Monday and Tuesday trade. Total notional volume for Wednesday came in at its highest level since early September, printing $2.5 billion, 107% above 30-day average volume. Bitcoin volume jumped back above the yard mark, coming in 60% above 30-day average volume. Ether volume soared to incredible heights, also clearing a yard (a much rarer event), and even exceeding bitcoin volume, coming in at $1.1 billion, 198% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $15,243 and average position size for ether running up to $7,089. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $2,904 and $233 respectively. |

| Latest industry news |

|

October has been an important month for bitcoin, with the asset soaring to a fresh record high after the long-awaited US bitcoin ETF finally went live. The move is significant as it pushes the space that much more into the mainstream, allowing traditional investors even easier access to taking on some form of exposure. And bitcoin hasn’t been alone with respect to enjoying a rally. The run-up in the price of bitcoin has carried the rest of the cryptocurrency space with it. Ether has done a good job keeping pace with bitcoin, despite stalling out just shy of its own record high against the US Dollar from earlier this year. But ether has been the star of the year, up as much as well over 400% YTD, as compared with bitcoin, which has traded up as much as just over 100% YTD. The wider appeal of Ethereum’s more front-end friendly applications has definitely been responsible for the blockchain’s success. Earlier in the year it was the decentralized finance boom, and lately it’s been the rocket ship rise of NFTs and the mass adoption we’re seeing on that front. But looking out, we wouldn’t be surprised to see some more consolidation and correction ahead, before these markets try get going with any meaningful bullish continuations. We believe a healthy round of profit taking is due, where shorter-term traders with less conviction will get washed out. We also believe there are still risks associated with regulatory headwinds in China and the US that need to be considered. Finally, while there has been impressive evidence to suggest crypto assets as compelling portfolio diversification investments given uncorrelated properties with other major assets, on a short-term basis, we’re still not there yet. This means any shakeup in very extended US equities, could result in a massive bout of risk liquidation that ultimately translates to downside pressure on the crypto space. Of course, if this does play out, we are very optimistic about the ability for crypto assets to find formidable support into dips from such macro pressures given the very compelling medium and longer-term value proposition. We suspect we will continue to see strong demand from institutional players into the end of Q4 2021 and well into 2022. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

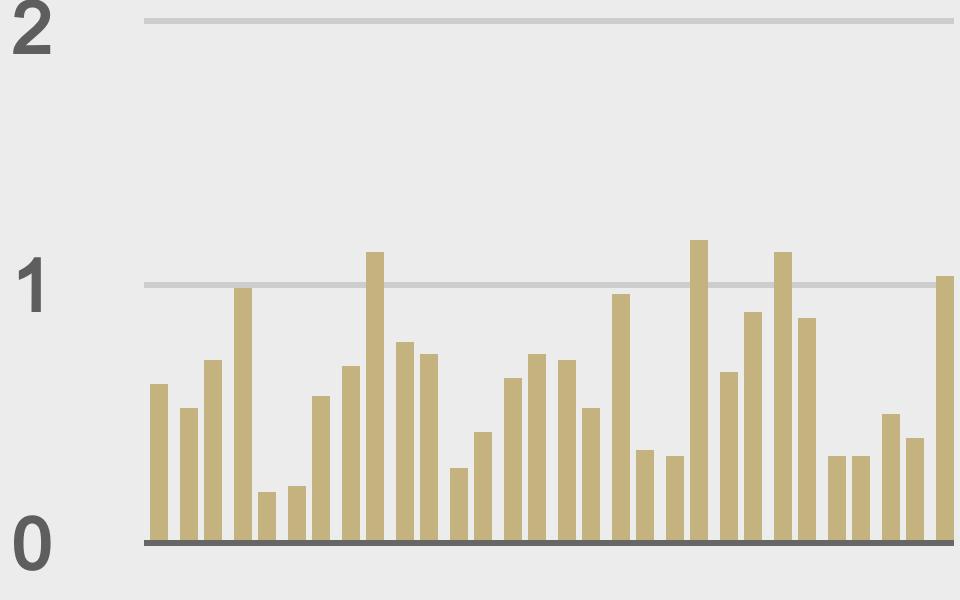

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@Negentropic_ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||