|

|

2 December 2021 Ether to bitcoin ratio is interesting |

| LMAX Digital performance |

|

LMAX Digital volume continue to trade at impressive levels this week. Total notional volume for Wednesday came in at $1.2 billion, 6% above 30-day average volume. Bitcoin volume came in at $593 million, 1% above 30-day average volume. Ether volume was more impressive on Wednesday, at $455 million, 25% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,218 and average position size for ether running up to $9,044. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $2,856 and $274 respectively. |

| Latest industry news |

|

We’ve seen some interesting market dynamics this week. All week, we’ve highlighted how we think a lot of the price action going forward will be sensitive to developments in traditional financial markets. And we’ve certainly seen evidence of this. As stocks have come under pressure this week, so too has the price of bitcoin. The risk off flow combined with Dollar demand on a more hawkish Fed communication have been behind a lot of this move. And yet, interestingly enough, the price of ether has proven exceptionally resilient, even immune to movements in stocks. But we would take this with a grain of salt, as we don’t believe the price of ether will be able to hold up should we continue to see downside pressure in US equities. If we’re talking ether versus bitcoin, it’s ether that is the more risk correlated crypto of the two. And so, it stands to reason that ether should be hit harder than bitcoin in the event of a more extended deterioration in risk sentiment. This leaves us looking at what we believe to be a highly overextended and vulnerable ether to bitcoin ratio. Ether has traded up to its highest levels against bitcoin since June of 2018 and this rate is looking poised for a reversal the other way. |

| LMAX Digital metrics | ||||

|

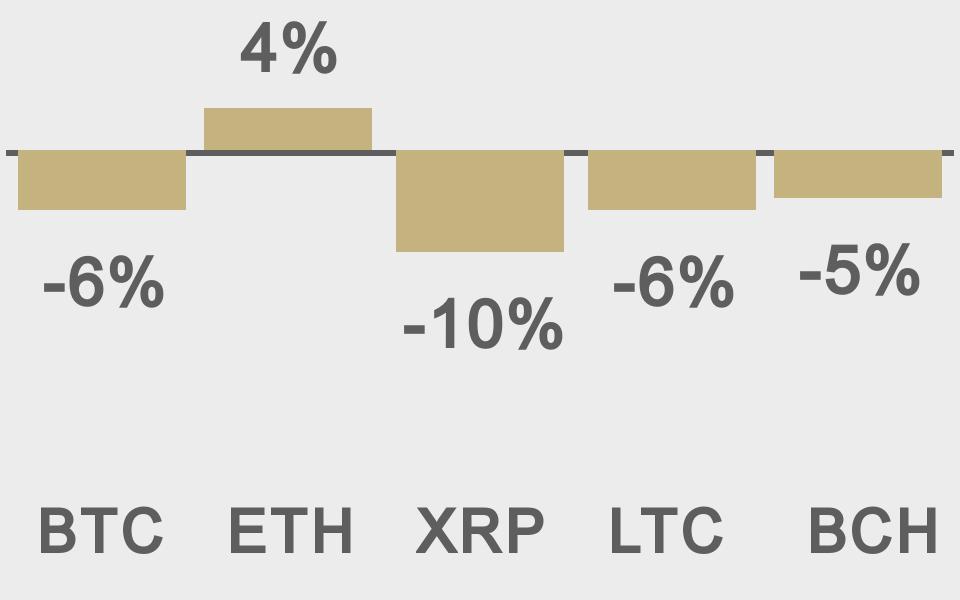

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@saylor |

||||

|

@Blockworks_ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||