|

| 9 June 2025 Euro’s rise boosts crypto appeal |

| LMAX Digital performance |

|

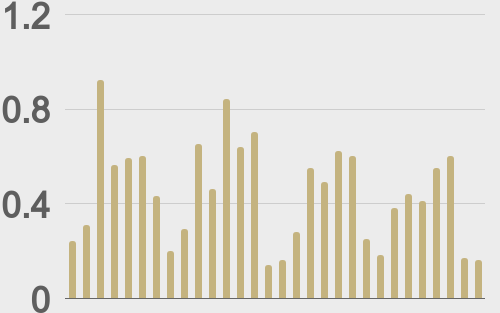

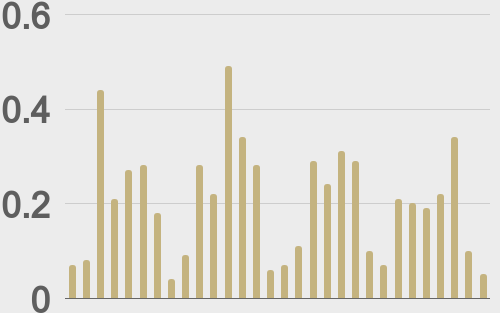

Total notional volume from last Monday through Friday came in at $2.4 billion, 6.5% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.1 billion, 8% lower than the previous week. Ether volume came in at $631 million, 6% higher than the week earlier. Total notional volume over the past 30 days comes in at $13.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,569 and average position size for ether at $3,209. Bitcoin volatility is still tracking just off recent yearly lows, while ETH volatility has picked up since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $2,688 and $124 respectively. |

| Latest industry news |

|

Bitcoin’s price action has remained calm since hitting a new record high in May, yet the outlook holds steady. As long as daily closes remain above $100,000, the focus is on a potential breakout toward $145,000, a target derived from the prior consolidation range of $75,000 to $110,000, reflecting a measured $35,000 move. A failure to hold above $100,000 could shift the short-term perspective, though strong support is expected around $90,000, with limited further downside. The medium-term trend remains robust, with significant demand likely to emerge on any weakness, sustaining the bullish momentum. Bitcoin’s resilience above $100,000 stems from robust institutional demand, with spot ETF inflows offsetting a $346.8 million outflow and exchange reserves dropping to a record low of 2.3 million BTC, while ETH benefits from ETF inflows despite flat network activity post-Pectra Upgrade. In traditional markets, ECB President Christine Lagarde’s advocacy for elevating the euro’s global stature, coupled with hints of joint eurozone debt issuance, challenges the dollar’s dominance, subtly enhancing cryptocurrencies’ allure as alternative assets. Easing concerns over trade wars and an improving trade outlook have bolstered risk assets, providing a tailwind for cryptocurrencies as investor confidence grows. Looking forward, this week’s U.S. inflation data, particularly the Consumer Price Index, will be pivotal in shaping expectations for Federal Reserve policy. Cooler-than-expected inflation could weaken the U.S. dollar, further supporting risk assets and likely lifting cryptocurrencies in tandem. |

| LMAX Digital metrics | ||||

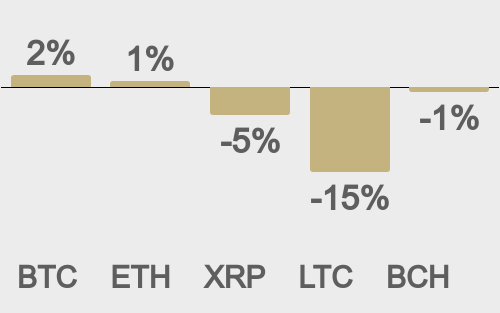

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

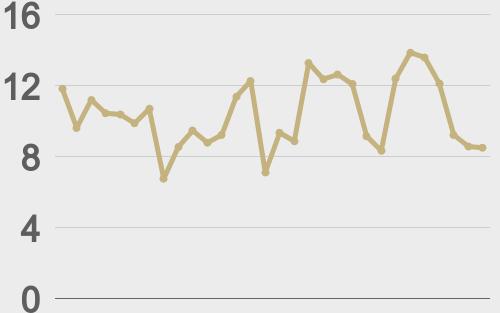

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

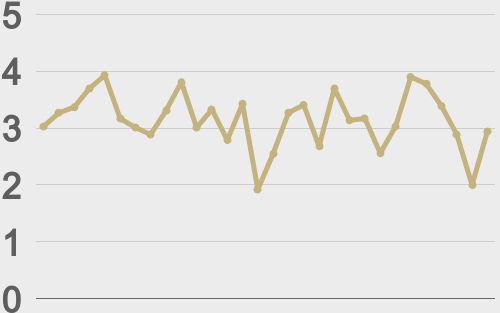

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||