|

|

21 November 2022 Expect thinner trading conditions this week |

| LMAX Digital performance |

|

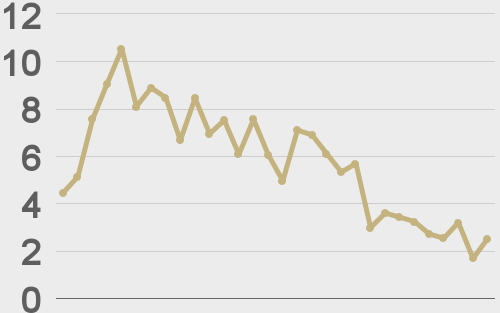

Total notional volume at LMAX Digital took a big dip in the previous week. Total notional volume from last Monday through Friday came in at just $1.3 billion, 75% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $836 million in the previous week, off 75% from a week earlier. Ether volume came in at $325 million, 79% lower from the week earlier. Total notional volume over the past 30 days comes in at $14.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,900 and average position size for ether at $2,816. Volatility is finally picking up off yearly and multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $809 and $89 respectively. |

| Latest industry news |

|

Fallout from the FTX implosion saga continues into the new week. This along with renewed downside pressure on global risk assets have been weighing on crypto, with bitcoin and ether extending declines to multi-session lows. The latest reports show FTX owing some $3 billion to its 50 biggest creditors, with the biggest single creditor being owed $225 million. And while all of this is happening, there have been fresh reports of additional unauthorized transfers from FTX accounts to other exchanges. We think there will be more shoes to drop in the days ahead as the ripples continue to work through the system and we believe this will lead to more downside pressure over the coming sessions. The fact that Fed officials have maintained their hawkish outlooks, even after the latest run of softer inflation data out of the US, has opened renewed downside pressure on stocks and a fresh wave of demand for the US Dollar, which has added to downside pressure on crypto. Technically speaking, we’ve highlighted risk for additional declines in bitcoin towards $10k following the recent breakdown to a fresh yearly low after the market had been consolidating for many weeks above $17,600. We suspect this move, should it play out, would also translate to a drop in the price of ether back towards a retest of its yearly low against the Buck. As a final note, trading conditions are expected to be thinner this week on account of the World Cup and on account of the shorter holiday week in the US. |

| LMAX Digital metrics | ||||

|

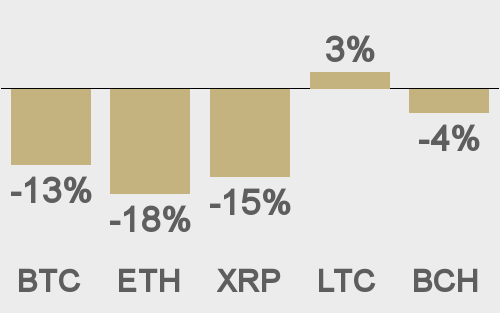

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||