|

|

8 July 2024 Expecting plenty of demand into this dip |

| LMAX Digital performance |

|

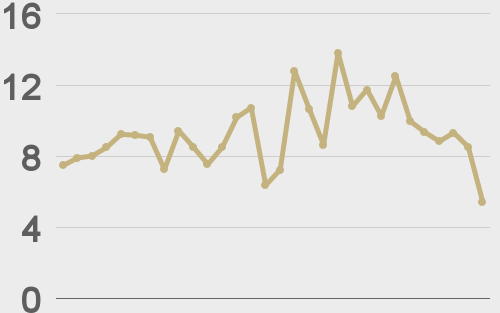

Total notional volume from last Monday through Friday came in at $2.4 billion, 7% lower than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.3 billion, 4% higher than the previous week. Ether volume came in at $801 million, 21% lower than the week earlier. Total notional volume over the past 30 days comes in at $11 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,366 and average position size for ether at $5,266. Market volatility is finally showing signs of wanting to pick back up after downtrending since March. We’re looking at average daily ranges in bitcoin and ether of $2,266 and $141 respectively. |

| Latest industry news |

|

There has been no denying the intense downside pressure on crypto assets over the past week or so. And yet, when we break it down, none of the market drivers are viewed as anything more than short-term setbacks. Most of the selling we’ve seen has been attributed to the Mt. Gox repayments, though there are other factors at play as well. The story around the German government selling bitcoin has added to the downside pressure which has only been further intensified on leveraged long liquidations and a major technical break in the price of bitcoin below the May low at $56,500. As per our technical insights, bitcoin’s break below $56,500 sets up the possibility for a double top formation that could open deeper setbacks in the days ahead towards $40,000. But we do think it will be important to see a weekly close below $56,500 to strengthen this short-term bearish case. We also believe the selling has been that much more aggressive in the absence of a US market off on holiday. This makes the double top trigger that much more suspect after playing out in thinner holiday trade, which is why we would need to see more confirmation on a weekly close before considering the possibility for a deeper setback. On balance, none of this has been shocking or unexpected and there has been nothing that has fundamentally altered the highly constructive outlook for bitcoin and crypto assets, suggesting additional downside should be limited in favor of a strong recovery, as medium and longer term players look to take advantage and build exposure into the dip. |

| LMAX Digital metrics | ||||

|

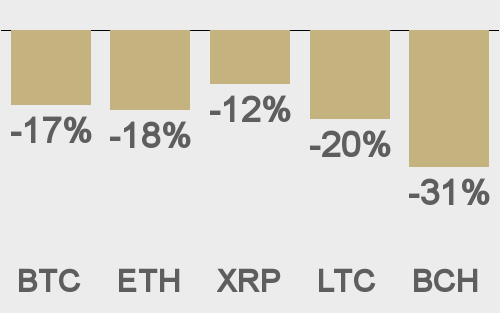

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

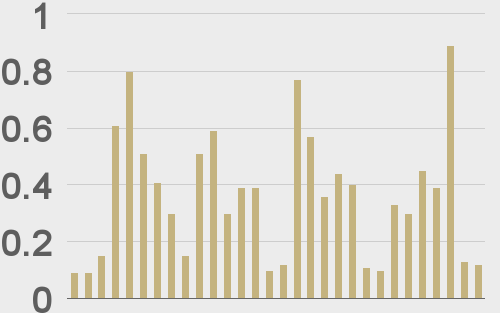

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

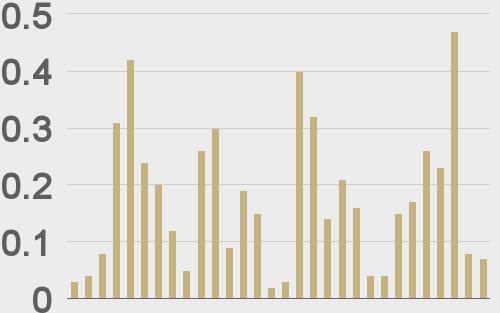

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

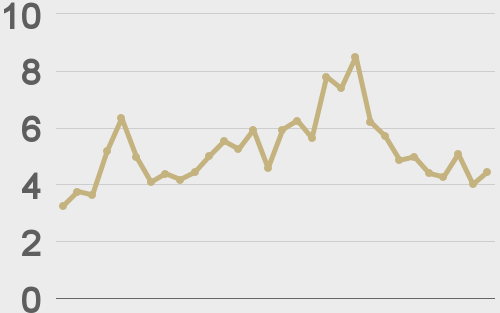

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||