|

|

27 March 2025 Expecting relative strength from here on |

| LMAX Digital performance |

|

LMAX Digital volumes were softer on Wednesday on account of some tight trading ranges. Total notional volume for Wednesday came in at $424 million, 13% below 30-day average volume. Bitcoin volume printed $264 million on Wednesday, 5% above 30-day average volume. Ether volume came in at $76 million, 20% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,218 and average position size for ether at $2,111. Bitcoin volatility has fallen back into a familiar consolidation range. ETH volatility has been trending lower towards multi-week lows. We’re looking at average daily ranges in bitcoin and ether of $3,375 and $118 respectively. |

| Latest industry news |

|

Following up on our Wednesday note, there continues to be many positive signs within the crypto market suggesting we could see a run of outperformance relative to US equities. Indeed, Q1 has been tough overall for crypto assets. But over the past 30 days, we’re seeing a bit of a shift, with the S&P500 down 2.85%, while bitcoin is up 2.75%. Initially, as 2025 got going, there was just too much priced in with respect to all of the positivity around a crypto friendly US administration, that it shouldn’t have come as a surprise to see some selling of the fact. Now that this is out of the way, the market is back to focusing on all of the favorable fundamentals and ongoing adoption from traditional players. This includes ramped up initiatives from the likes of Blackrock, new bank entrants, and companies adding to or starting to take on bitcoin balance sheet exposure. On Wednesday, American electronics retailer GameStop was the latest company out announcing plans to offer $1.3 billion in stock to fund bitcoin acquisitions. Looking ahead, we expect the US administration will continue to push forward in shaping crypto friendly policy, which should only help to invite continued demand into the remainder of 2025. Technically speaking, bitcoin has put in a healthy recovery out from recent lows. At this stage it’s difficult to determine if we have already seen a bottom in 2025. At the same time, any additional setbacks that we might see should be exceptionally well supported into the $70-75k area. |

| LMAX Digital metrics | ||||

|

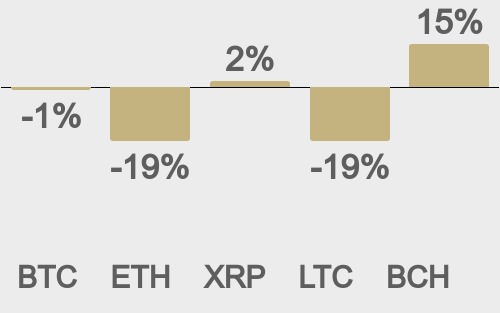

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

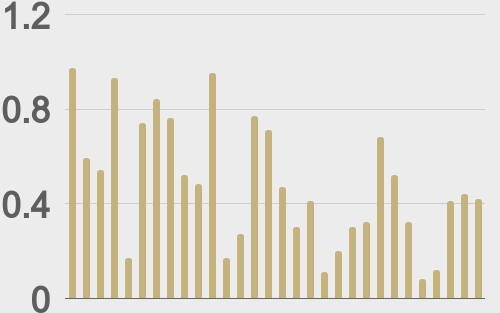

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

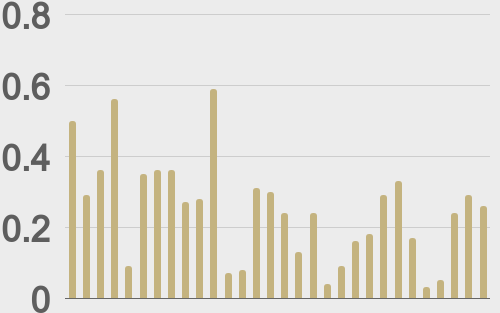

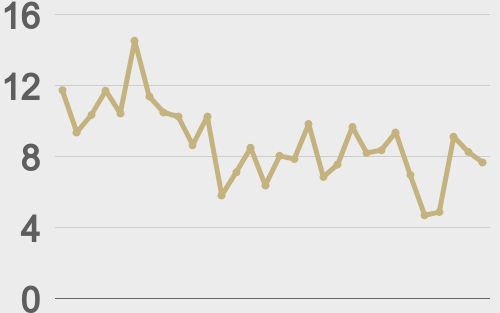

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

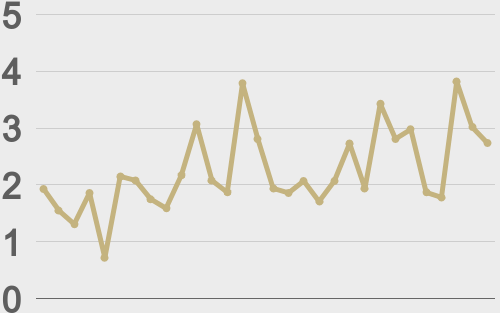

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||