|

|

6 December 2022 Experts weigh in on price outlook |

| LMAX Digital performance |

|

LMAX Digital volumes got off to another slow start this week. Total notional volume for Monday came in at 220 million, 36% below 30-day average volume. Bitcoin volume printed $120 million on Monday, 41% below 30-day average volume. Ether volume came in at $46 million, 49% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,290 and average position size for ether at 2,184. Volatility has been anemic in 2022, and after seeing a little pick-up in recent weeks, we’re right back down to yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $546 and $63 respectively. |

| Latest industry news |

|

In Monday’s piece, we had warned there would be risk for a resumption of risk-off flow, particularly in the aftermath of last Friday’s US jobs report, which pointed to the need for the Fed to keep on pushing ahead with more restrictive, less investor friendly monetary policy. And indeed, this is how things played out. Currencies sold off against the US Dollar, stocks were in retreat mode, and cryptocurrencies headed south as well in sympathy. Overall, despite a recent bounce, the trend and outlook for crypto remains bearish, with scope for deeper setbacks before we eventually bottom out. Interestingly enough, many experts have been out expressing their views about the outlook for bitcoin. Most of these views have been exceptionally favorable, though some have been less upbeat over the coming months. Standard Chartered was the real standout, after the bank’s chief strategist called for bitcoin to head down to $5,000 in 2023. But as we said, most views were more upbeat. These included calls from renowned VC Tim Draper for bitcoin to trade to $250k next year, highlighting his belief that the FTX implosion would lead to greater decentralization and adoption of bitcoin. Hedge fund manager Mark Yusko was out calling for the next bull run to start in Q2 2023, a view that we believe is certainly realistic. As we consider all of the fundamentals in play, it does feel like there could be one more healthy drop in crypto assets into the end of the year or Q1 2023, before the market is finally ready to get going again. |

| LMAX Digital metrics | ||||

|

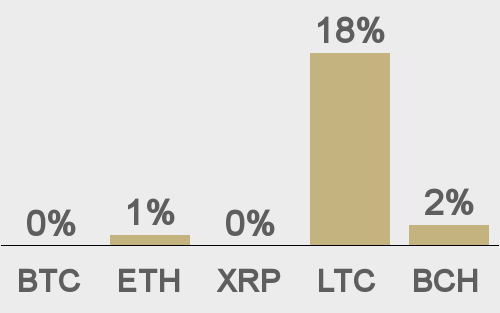

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

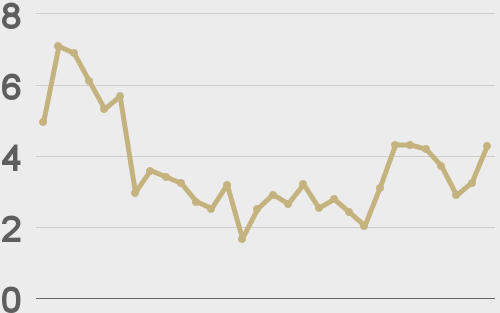

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

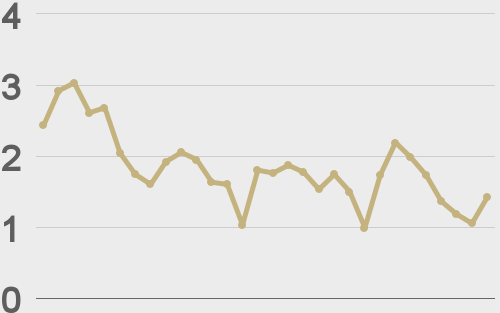

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||