|

|

4 March 2024 February in Review |

| LMAX Digital performance |

|

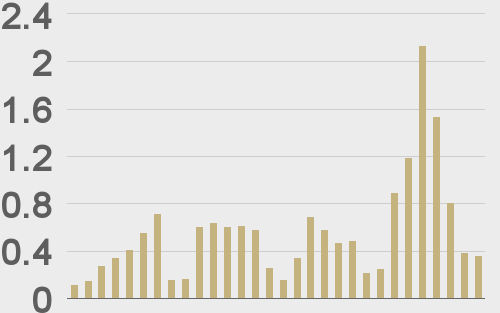

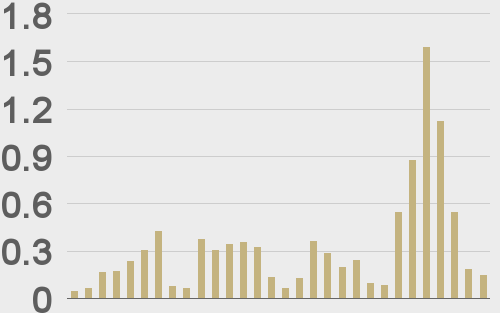

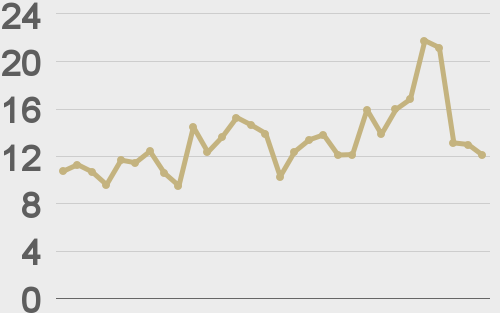

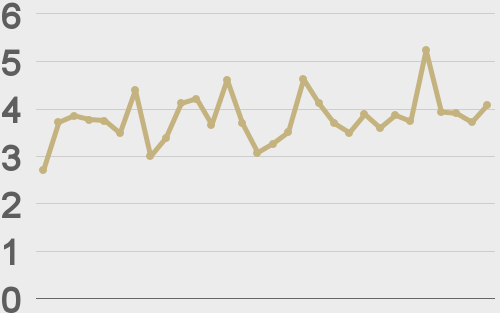

Total notional volume at LMAX Digital skyrocketed in the previous week. Total notional volume from last Monday through Friday came in at $6.6 billion, 156% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $4.7 billion in the previous week, 281% higher than the week earlier. Ether volume came in at $1.1 billion, 21% higher than the week earlier. Total notional volume over the past 30 days comes in at $16.8 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,836 and average position size for ether at $3,911. Volatility has been trending back towards the record high from early January. We’re looking at average daily ranges in bitcoin and ether of $2,117 and $126 respectively. |

| Latest industry news |

|

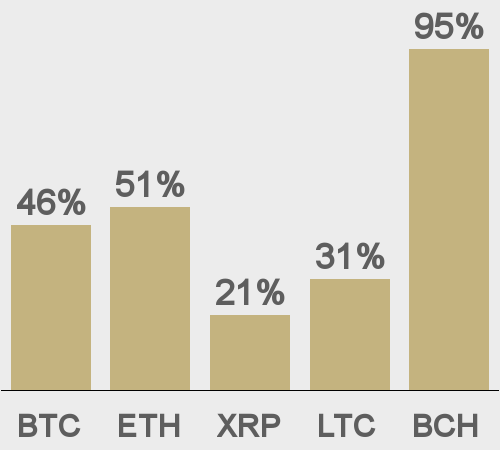

We come into the month of March on the back of a stellar February performance for crypto assets. Bitcoin closed out the month with a bang, up nearly 45%, while ether was even a tad more impressive, closing out the month up over 46%. Technically speaking, the price action puts both bitcoin and ether in position to retest and break their respective record high levels from 2021. As far as market drivers go, there have been a number of critical influences behind the surge in demand. The primary source of strength has come from the approval and initial reaction to the spot bitcoin ETFs in the US. The January approval opened the door for mainstream adoption of these limited supply assets, while the reception to the ETFs through February was incredible, sending a strong signal to the market that we should only expect continued demand going forward. Another source of demand has been performance in bitcoin and the broader crypto asset class relative to traditional markets. In 2024, correlations between crypto and traditional risk assets have been running low, something that makes crypto as an asset class all the more attractive as a portfolio diversification option. And looking ahead to the remainder of 2024, market participants are getting excited about cyclical studies that show plenty of demand for bitcoin around halving events (the next halving event is scheduled for April). They are also getting excited about the increased prospect that the next wave of spot ETF approvals will go through in the US, this time by way of ether spot ETF approvals. As far as risks go, we don’t see much to worry about over the medium and longer-term and expect adoption will continue to ramp up and drive crypto assets higher. However, as per our technical insights, price action has gone parabolic, which suggests things could cool off for a moment before the uptrend continues. One other short-term risk we’re focused on is the risk that a massive liquidation in US equities could spill over into crypto assets and derail all of the positive momentum we’ve been seeing in 2024. But again, on the technicals side, any setbacks would be classified as a correction within a very strong uptrend. And as far as US equities go, for one thing, they haven’t shown any signs of slowing down, and even if they do, we believe there has been enough of a clear break in correlations that any setbacks in crypto we do see from such a development, would be short-lived as medium and longer-term crypto market participants look to take advantage of building exposure into dips. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||