|

|

4 May 2023 Fed decision translates to higher crypto prices |

| LMAX Digital performance |

|

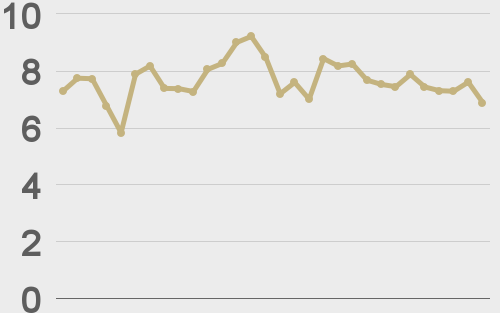

LMAX Digital volumes were up overall on Wednesday. Total notional volume for Wednesday came in at $445 million, 4% above 30-day average volume. Bitcoin volume printed $268 million on Wednesday, 6% above 30-day average volume. Ether volume printed $118 million, 1% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,640 and average position size for ether at 2,896. Volatility has been in correction mode after peaking out at a yearly high in March, though we are seeing signs of volatility turning back up again. We’re looking at average daily ranges in bitcoin and ether of $1,048 and $73 respectively. |

| Latest industry news |

|

Bitcoin and ether have recovered in the aftermath of a Fed decision that ultimately has proven to be supportive of global risk assets. Wednesday’s market reaction was less about the as expected 25 basis point rate hike and more about the accompanying communication which seemed to open the door to a possible pause on rate hikes. What this translates to is yield differentials moving out of the US Dollar’s favor as the market prices in a less aggressive Fed policy track. And as those yield differentials move out of the US Dollar’s favor, currencies benefit, which by extension, also works to the benefit of bitcoin and ether. Moreover, we’ve already seen relative outperformance in cryptocurrencies relative to traditional risk assets as vulnerabilities in the banking sector continue to shine a positive spotlight on crypto’s value proposition. Technically speaking, while bitcoin and ether have been well supported, we are confined to a sideways consolidation waiting to get broken. This means we will need to see bitcoin push back above the yearly high to open the next major upside extension. |

| LMAX Digital metrics | ||||

|

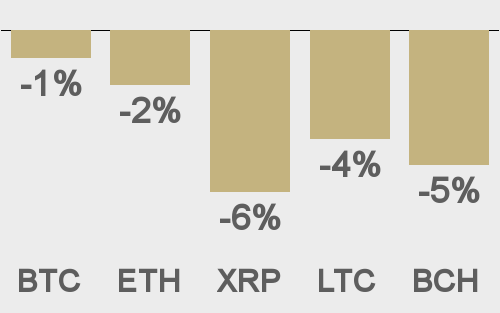

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

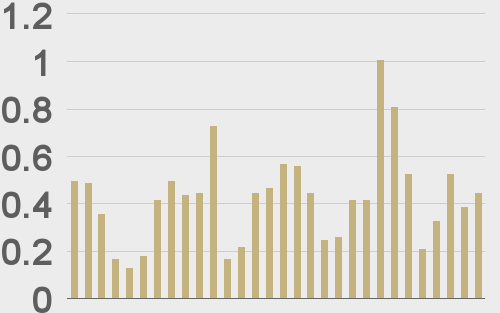

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

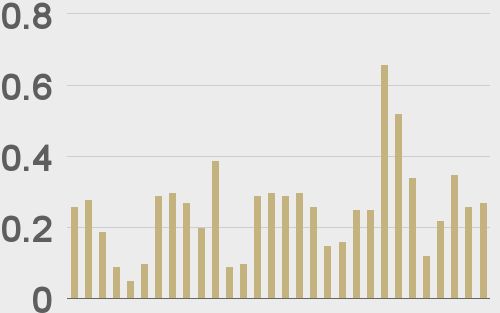

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

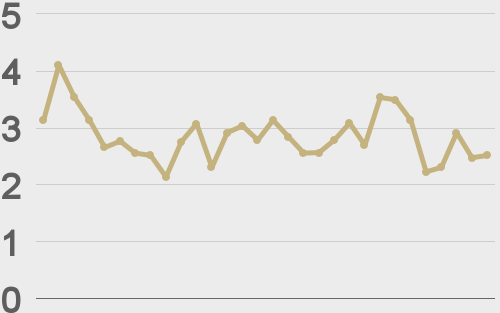

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||