|

|

8 January 2025 Fed repricing invites selling pressure |

| LMAX Digital performance |

|

LMAX Digital volumes picked up on Tuesday. Total notional volume for Tuesday came in at $665 million, 4% above 30-day average volume. Bitcoin volume printed $348 million on Tuesday, 5% above 30-day average volume. Ether volume came in at $161 million, 71% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,683 and average position size for ether at $2,268. Market volatility has cooled off since topping out in December. We’re looking at average daily ranges in bitcoin and ether of $3,605 and $173 respectively. |

| Latest industry news |

|

Bitcoin and crypto assets across the board have come under pressure over the past 24 hours. Indeed, on a short-term basis the setbacks have been rather intense. At the same time, when taking a step back, there has been no change to the constructive outlook. Technically speaking, bitcoin has been in a bullish consolidation above $90k. Until we see $90k broken to the downside, the market should be thinking about being well supported on dips ahead of a continued push to the topside. When looking at the price of ETH, the story is very much the same. The Tuesday retreat was intense, and yet, the market has been consolidating since mid-December with no major levels broken since. Key support for ETH comes in at $3,100. It would take a break below this level to suggest we could be seeing a more meaningful pullback. Until then, look for setbacks to be very well supported into the dip ahead of the next major upside extension. Fundamentally, a lot of this latest weakness seems to be coming from all things global macro. Another strong run of US economic data on Tuesday has translated to a further hawkish repricing of Fed rate cut bets, which in turn has driven US yields and the US Dollar higher across the board. |

| LMAX Digital metrics | ||||

|

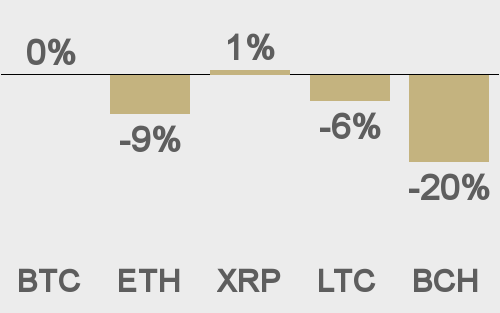

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

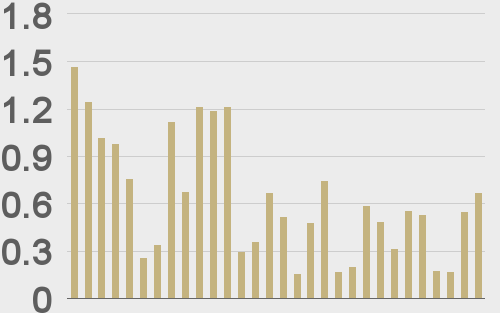

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

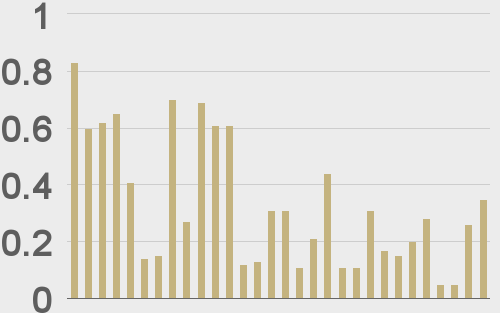

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||