|

|

| Fed risk and crypto |

| LMAX Digital performance |

|

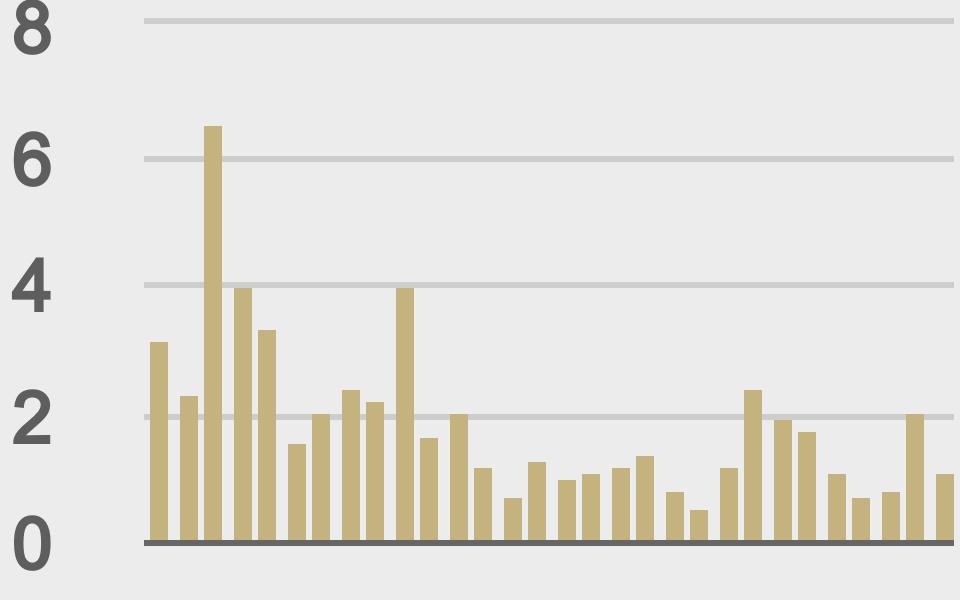

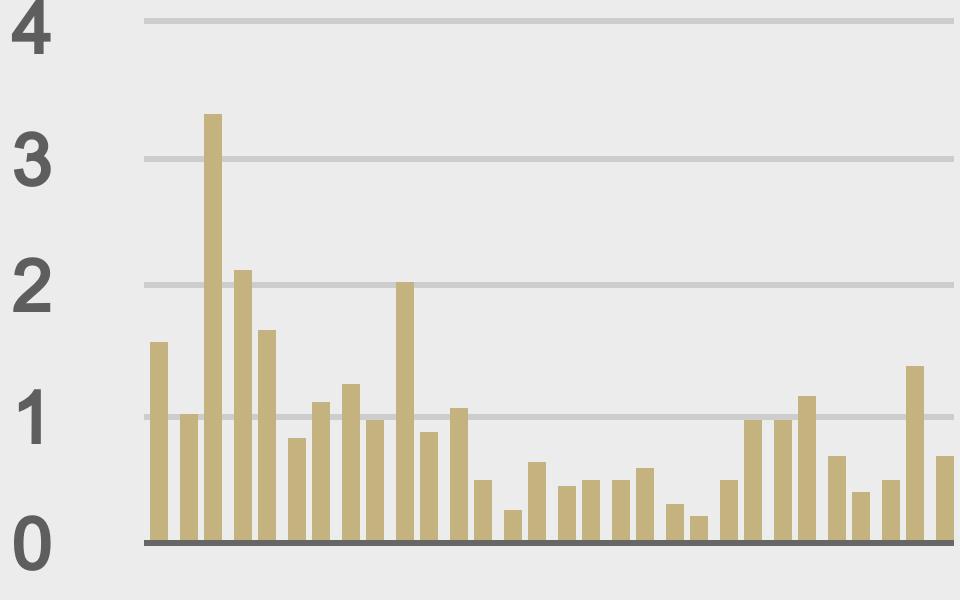

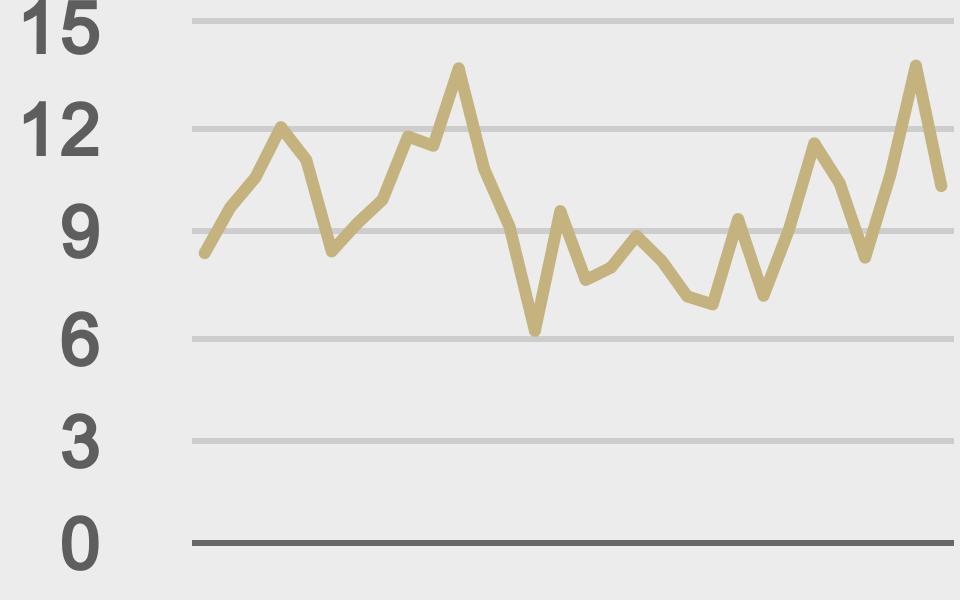

LMAX Digital volumes were lower on Tuesday. Total notional volume came in at $1.1 billion off 42% from 30-day average volume. Bitcoin volume came in at $693 million, down 29% from 30-day average volume. Ether volume took the hardest hit, coming in at $258 million, off 54% from 30-day average volume. Total notional volume at LMAX Digital over the past 30 days comes in at $57.9 billion. Average trading size for Bitcoin came in at $10,290 on Tuesday. Average trading size for Ether came in at $4,761 on Tuesday. The average daily trading range for BTCUSD is $3,222. The average daily trading range for ETHUSD is $271. |

| Latest industry news |

|

All of the positive news out of the crypto space this week has been having a positive impact on the price of crypto assets. Unsurprisingly, this has translated to an uptick in the market caps of Bitcoin mining firms as well. As a reminder, this week’s good cheer revolves around the stories of MicroStrategy unveiling a $1 billion stock offering in an effort to accumulate more Bitcoin, Paul Tudor Jones increasing his overall exposure to Bitcoin, a survey showing hedge fund managers expecting to hold 7% of assets in crypto within 5 years, and bullish talk from Mark Cuban around the future of DeFi. But we also continue to warn against expectations that crypto assets are about to race back to the topside towards a retest of the record highs from earlier this year. The other day, we highlighted technical resistance above $40,000 in the price of Bitcoin. And today, we feature obstacles that stand in the way of Ether. Fundamentally, we’re still concerned about short-term downside risk associated with a correction in extended US equities and downside risk associated with regulatory headwinds. As far as equities go, any signs of an earlier than expected taper from the Fed could rattle risk assets. Meanwhile, on the regulatory side, there continues to be quite a bit of rhetoric around new policy measures that would make things more difficult for the crypto market. |

|

LMAX Digital metrics |

||||

|

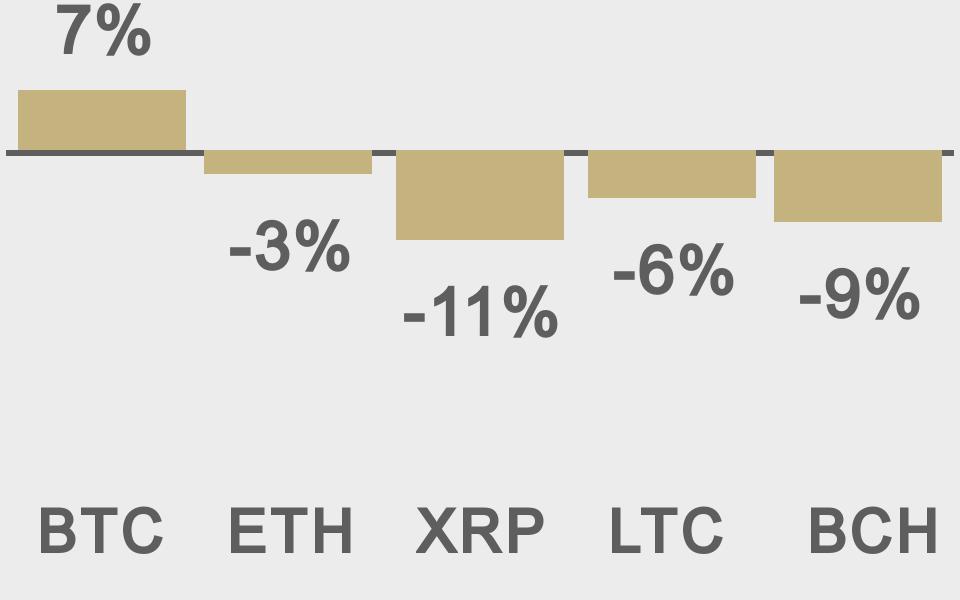

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

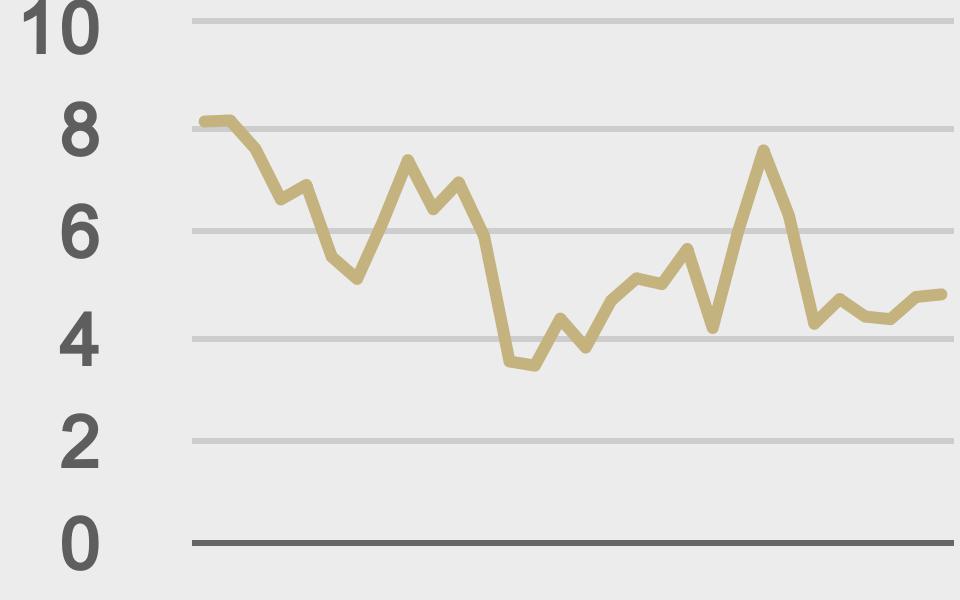

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@fintechfrank |

||||

|

@KenzieSigalos |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||