|

|

2 July 2024 Focus shifts back to traditional markets |

| LMAX Digital performance |

|

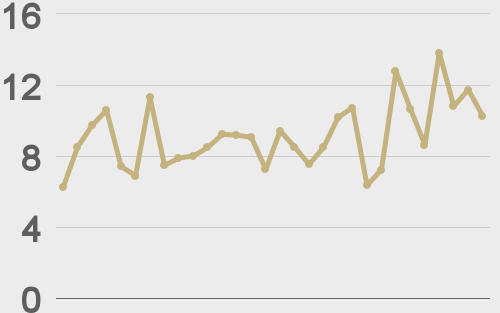

LMAX Digital volumes opened the week rather quietly. Total notional volume for Monday came in at $330 million, 12% below 30-day average volume. Bitcoin volume printed $151 million on Monday, 19% below 30-day average volume. Ether volume came in at $140 million, 1% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,395 and average position size for ether at $5,055. Market volatility continues to trend lower since peaking in March. We’re looking at average daily ranges in bitcoin and ether of $1,943 and $122 respectively. |

| Latest industry news |

|

Bitcoin and Ether did their best to try and mount healthy rallies to start the week, though as Monday wore on, the rallies stalled out with prices gravitating back to daily opening levels. Overall, we don’t think there’s too much to read into with respect to the choppy Monday performance. Ultimately, what it comes down to right now is a bitcoin market that could be on the verge of pushing back towards the record high after already seeing a healthy correction since topping out in June. As per our technical insights, so long as bitcoin holds above $56,500, the outlook remains highly constructive. Fundamentally speaking, there has been a bit of a lull in recent days. The market is waiting for the ETH ETFs to go live, and the expectation is that this won’t happen until next week. While crypto market participants wait on this event, most of the attention will likely shift to updates from the traditional markets front, mostly pertaining to the Fed policy outlook. There has been a growing concern the Fed will be reluctant to accommodate investor expectations for more rate cuts than less in 2024, which could in turn weigh on currencies across the board, weigh on risk sentiment, and spillover into crypto. At the same time, US economic data has been softer of late. Should this keep up, and should inflation show it’s being contained, investors could get everything they hope for, which would then fuel US Dollar outflows, risk on sentiment and positive carryover into the crypto market. As far as interesting market related stories go, it’s worth noting Circle has become the first global stablecoin issuer to be licensed and approved under the EU’s MiCA framework. |

| LMAX Digital metrics | ||||

|

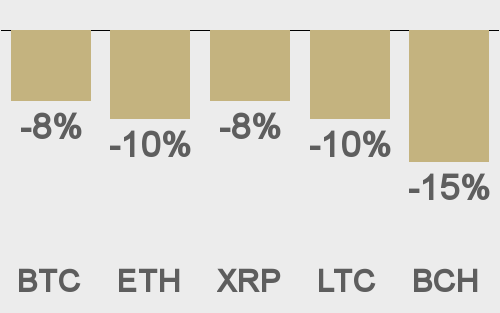

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

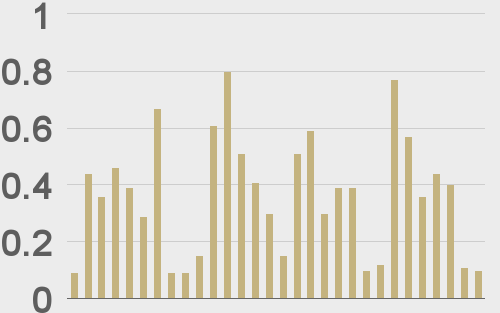

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

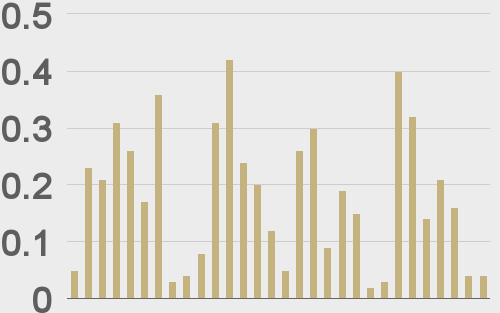

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||