|

|

13 June 2023 Focus shifts to key event risk |

| LMAX Digital performance |

|

LMAX Digital volumes were down slightly overall on Monday. Total notional volume for Monday came in at $284 million, 5% below 30-day average volume. Bitcoin volume printed $135 million on Monday, 17% below 30-day average volume. Ether volume came in at $103 million, 15% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,009 and average position size for ether at 2,972. Volatility is showing signs of wanting to pick back up in recent sessions after trading down to the lowest levels since earlier this year. We’re looking at average daily ranges in bitcoin and ether of $832 and $57 respectively. |

| Latest industry news |

|

The market has absorbed the fallout from last week’s news around the SEC lawsuits and has done a good job taking the news in stride. Already into Tuesday, we’re seeing some signs of the possibility for things to want to turn back up. As per our technical insights, bitcoin is in the throes of a correction within what is believed to be the start to the next big push higher after the market bottomed in 2022. This should translate to the formation of a higher low ahead of $20k. As far as this week goes, it looks like it could be a whole lot less about updates from the regulatory front, and a whole lot more about US economic data and the Fed policy decision. Later today, we get a very important US inflation read. Should the data come in above forecast, it would likely open the door for a big reversal of flow in US equities, which could then weigh on crypto. Then on Wednesday, we get the Fed decision. If the Fed ends up leaning more towards the hawkish side, this could be another disrupter for the crypto market. If on the other hand US inflation comes in soft and the Fed leans more accommodative, there could be more room for crypto to want to be pushing higher. |

| LMAX Digital metrics | ||||

|

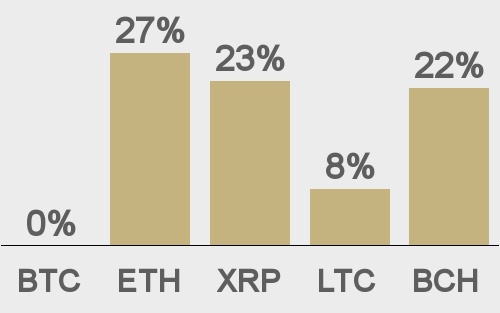

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

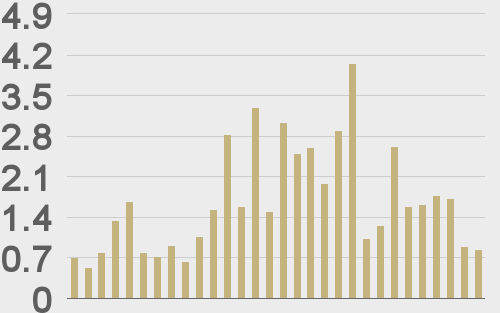

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

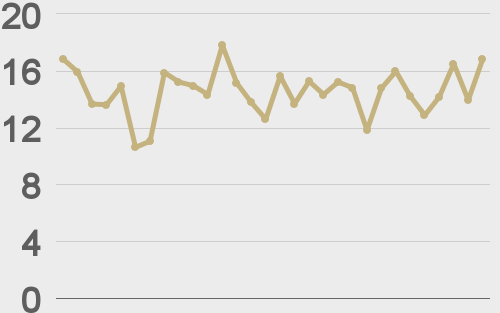

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||