|

|

21 March 2023 Focus shifts to Wednesday’s FOMC decision |

| LMAX Digital performance |

|

LMAX Digital volumes continued to run healthy as the week got going. Total notional volume for Monday came in at $592 million, 20% above 30-day average volume. Bitcoin volume printed $378 million on Monday, 27% above 30-day average volume. Ether volume came in at $143 million, 28% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,185 and average position size for ether at 3,396. Volatility has turned up nicely in recent sessions and, trading to a fresh yearly high. We’re looking at average daily ranges in bitcoin and ether of $1,241 and $82 respectively. |

| Latest industry news |

|

The Fed’s recent move to inject liquidity into the banking system has been taken as a sign the central bank is concerned with all that’s been going on, which in turn has given the market an indication the central bank won’t be looking to be as aggressive on rates when it meets tomorrow. Interestingly enough, all of this has put a positive spotlight on bitcoin, with the market now waking up to alternative custody and banking solutions via cryptocurrency. Counterparty risk has become a major concern in the legacy system, and cryptocurrencies offer an attractive solution. We do believe we should still expect some volatility around tomorrow’s FOMC decision, especially with the market having been so aggressive in repricing rates lower. This sets up the possibility for a let down, where the Fed still manages to communicate a hawkish message, which ultimately drives yield differentials back to the US Dollar. Technically speaking, we’ve highlighted the significance of the latest bitcoin weekly close above $25k. The price action suggests the market has finally bottomed out, and is now looking to start making the journey back towards and eventually through the record high from 2021. We suspect any setbacks should now be very well supported ahead of $20k. |

| LMAX Digital metrics | ||||

|

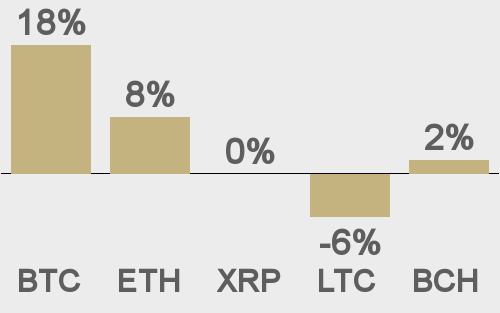

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

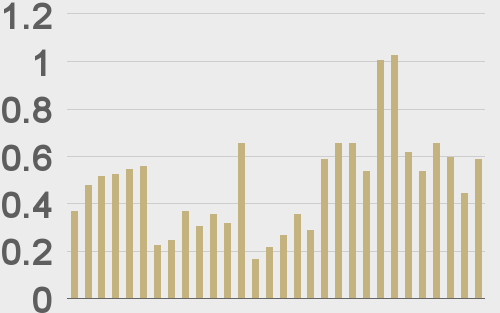

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

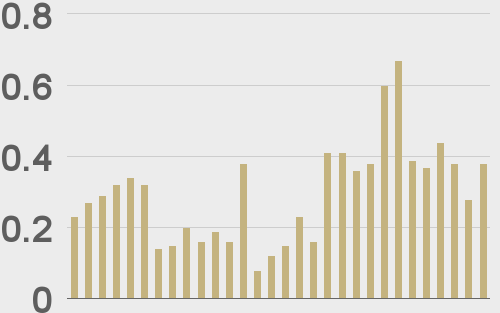

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||