|

|

8 November 2023 Focusing in on the technicals |

| LMAX Digital performance |

|

LMAX Digital volumes turned back up on Tuesday after a slow start to the week. Total notional volume for Tuesday came in at $376 million, 22% above 30-day average volume. Bitcoin volume printed $201 million on Tuesday, holding steady with 30-day average volume. Ether volume came in at $106 million, 46% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,035 and average position size for ether at $2,764. Volatility has settled down in recent sessions after breaking to the topside, out from multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $1,013 and $56 respectively. |

| Latest industry news |

|

Absence of any meaningful fundamental updates into the midweek leaves us focusing in on all things technical. The key takeaway right now is that the overall outlook for crypto assets remains constructive, with further upside expected over the near-term. We suspect this bullish price action will be led by the bitcoin price, given bitcoin’s ability to find demand in times of risk on and risk off. As far as bitcoin price action goes, we’ve been confined to a bullish consolidation over the past several sessions since the market broke out to a fresh 2023 high. Indeed, we’re coming out of a bullish performance on Tuesday. But at the same time, until we clear $36,000, there is no change to the shorter-term picture. A break above $36,000 will open the door for bullish continuation towards the next measured move extension target objective which comes in at $40,000. Key short-term support comes in at $33,400 and it would take a break below this level to take the immediate pressure off the topside. |

| LMAX Digital metrics | ||||

|

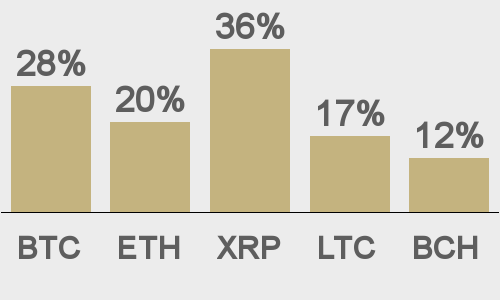

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

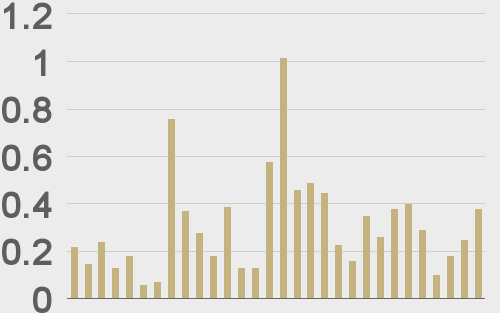

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||